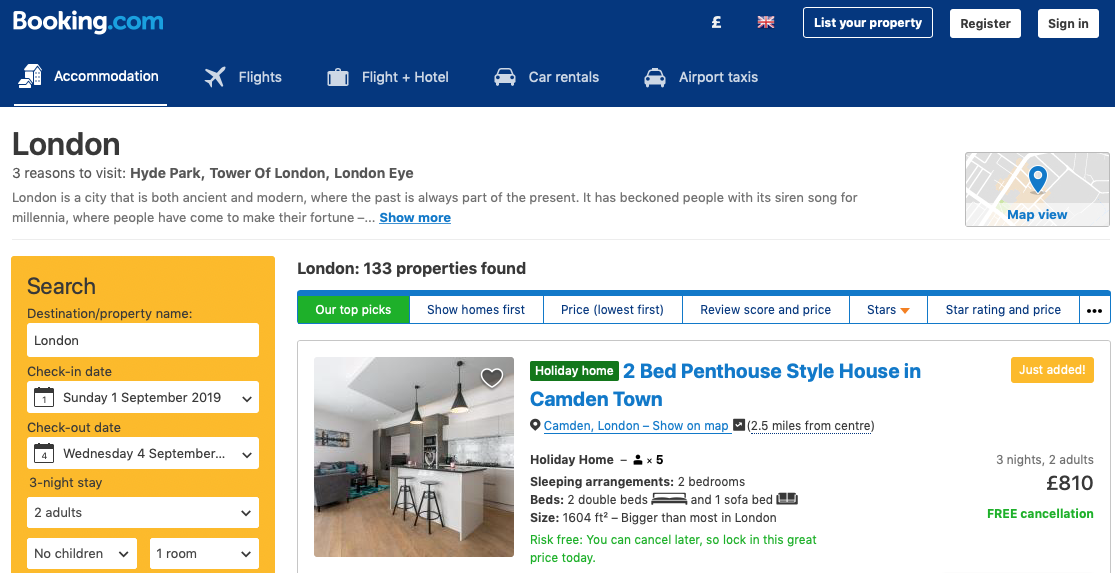

Booking.com under investigation for ‘millions of unpaid VAT’

Booking.com could be forced to pay at least €150 million in unpaid VAT on private holiday rentals booked through its websites, according to reports.

Italian authorities are allegedly looking into whether the online giant is liable for the tax owed on payments made to the site between 2013 and 2018.

The payments were for rental properties advertised on the site by private individuals, not professionally-run hotels booked through the website as these are already registered to pay the tax.

Booking.com considers itself an intermediary between private rental property owners and guests and treats reservations as direct transactions between the two.

But those close to the investigation told the Financial Times that a lack of an automatic system for VAT payment means that the tax often goes unpaid, resulting in a ‘significant’ shortfall over time.

Italian prosecutors consider the €150 million figure a ‘conservative estimate’ for the six-year period, according to sources, based on an analysis of the company’s revenues in Italy and police interviews with individuals using its platform.

Last year, Italian authorities contacted their counterparts in the Netherlands, where Booking.com is based, to request evidence via a European Investigation Order, but the Dutch declined to proceed with the case, according to the FT.

Italian authorities now intend to file a revised European Investigation Order to push the case forward. The Dutch prosecutor’s office declined to comment, citing confidentiality.

Booking.com said it had not been notified of any issue by Italian authorities. It added that the commission it charges its accommodation partners, such as those renting out their properties, is subject to VAT and ‘it is [their] responsibility to report this directly to local government’ in the EU.

Airbnb, which also takes bookings for privately-owned rental properties advertised by individuals, collects tax on behalf of the Italian government before passing the payments on, said the FT.

In March, the UK’s HM Revenue & Customs issued a ‘call for evidence’ in an attempt to improve VAT compliance by individuals using websites such as Booking.com, Amazon and Uber to sell goods or services.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

Boy falls to death on cruise ship

Dozens fall ill in P&O Cruises ship outbreak

Turkish Airlines flight in emergency landing after pilot dies

Unexpected wave rocks cruise ship

Woman dies after going overboard in English Channel