Guest comment: Why Priceline courted Kayak

The US$1.8 billion acquisition of meta search engine Kayak by Priceline is not only a significant milestone for online travel due to their size and the role these two companies play in the travel industry, but also helps to illustrate the most recent developments taking place in online travel. Online travel analyst at Euromonitor International, Angelo Rossini, investigates further.

Such developments include the threat that Google’s strengthening position in travel may represent tensions between airlines on one side vs GDS and OTAs on the other and the growing importance of the mobile channel, as well as online travel brands.

Meta giant

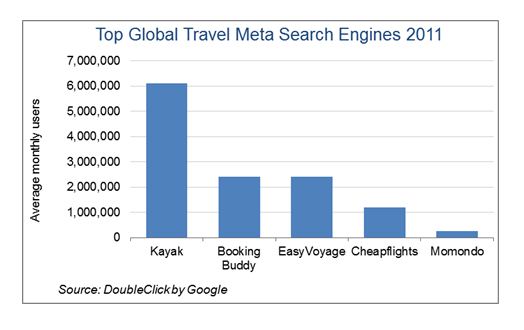

Kayak is the largest meta search travel website in the world, leading a sector which has been growing fast over the past five years thanks to travellers increasingly using the web to find the best price and increasingly turning to meta search sites, attracting the likes of giants such as Google and now Priceline. In the third quarter of 2012, Kayak’s website generated 302m travel queries, recording a 31% growth over Q3 2011, and revenues of US$79m, up 29% on Q3 2011.

The Google threat

Google is strengthening its position in the travel industry by its entry into the meta search engine sector through Google Flight Search, which will soon enter the European market, Google Hotel Finder and the acquisition of ITA software. This represents a threat for Priceline which may see Google meta search results favour direct suppliers over OTAs. Buying Kayak is a smart move to ensure that it can combat Google’s threat from within the meta search sector and protect its core online hotel business.

Stronger position in online air bookings

Priceline’s CEO, Jeffery Boyd, denied that the Kayak acquisition was driven by the company’s desire to expand into online air bookings. However, there is no doubt that following this acquisition, Priceline’s competitive positioning in the online air market has been significantly strengthened.

Airline queries account for the bulk of Kayak queries, with a 84% share, but due to the lower revenues generated per query, air generated only 25% of Kayak revenues in 2011. Due to the strength of airlines’ direct web sales, using the meta search route appears much less risky for Priceline than going via the OTA route

Mobile shift and the loyalty factor

For Priceline, one major aspect of the acquisition was Kayak’s strong technology positioning, in particular as far as mobile development is concerned. Mobile bookings are expected to growth the fastest over the next five years in the online travel segment, and Kayak is well placed to b

enefit from this trend. Kayak achieved 3.1m appsdownloads in Q3 2012, and 56m mobile queries thanks to some of the most advanced and user-friendly apps and mobile websites available in the travel industry.

Priceline’s decision to acquire Kayak for US$1.8 billion, rather than create its own meta search engine, is recognition of the power of consumer loyalty that online travel brands have gained, which is becoming increasingly difficult and expensive to challenge.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

Boy falls to death on cruise ship

Dozens fall ill in P&O Cruises ship outbreak

Turkish Airlines flight in emergency landing after pilot dies

Unexpected wave rocks cruise ship

Woman dies after going overboard in English Channel