Mastercard is evolving its products and solutions to better meet travel buyer and supplier needs

TravelMole caught up with Rohnny Swennen, Vice President, Travel Industries, to hear about how Mastercard is evolving its products and solutions to better meet travel buyer and supplier needs.

Rohnny shed light on how the Mastercard Wholesale Program has been enhanced and what this means for the sector.

What is the Mastercard Wholesale Program and how did that innovation come about?

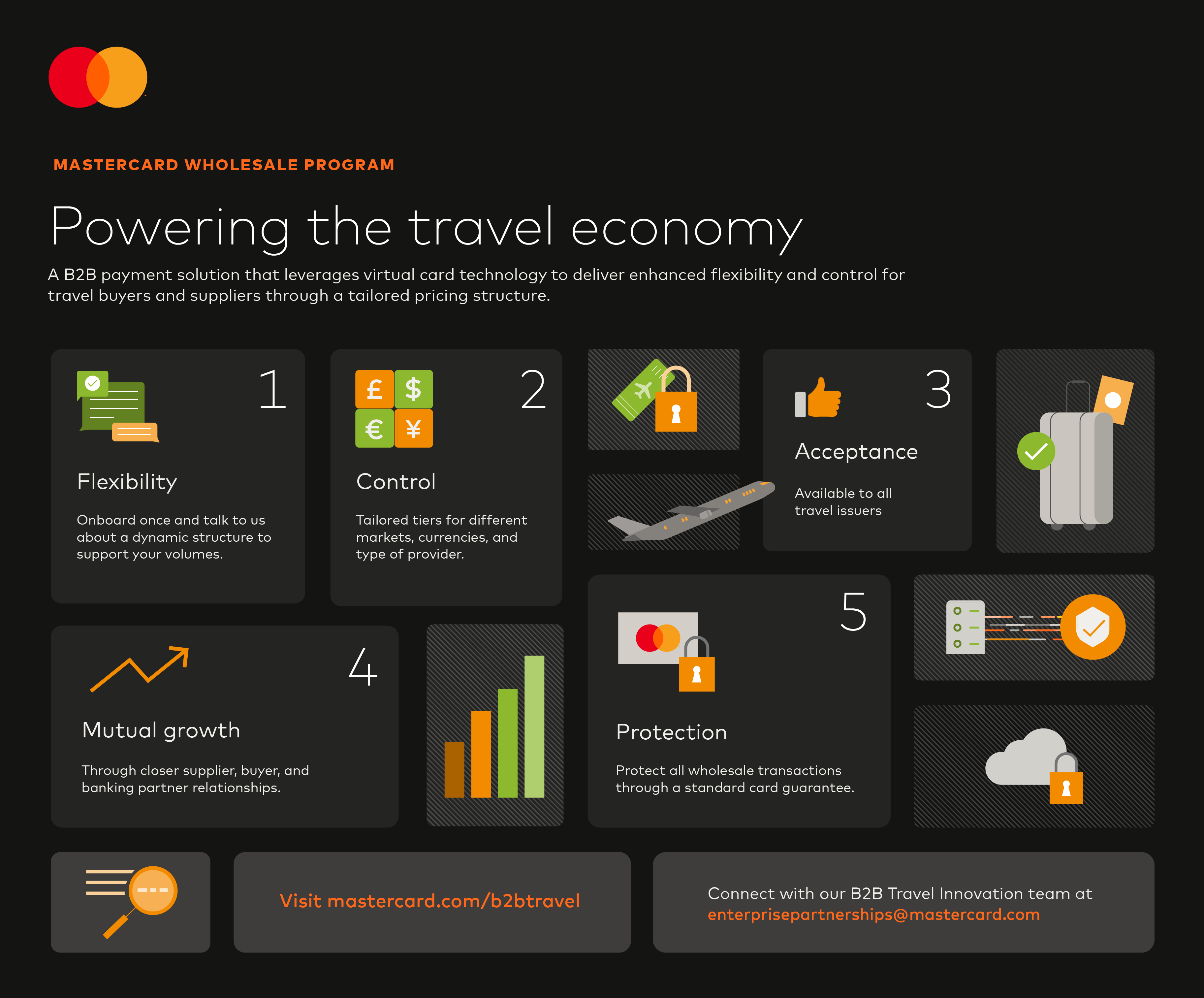

The Mastercard Wholesale Program is a business-to-business (B2B) payment solution that allows travel intermediaries to pay their partners and suppliers with greater flexibility, visibility, and protection. It was designed specifically for the travel sector, based on what we heard from our partners and customers about their B2B payment challenges.

From the outset we wanted this product to reflect industry needs so we considered what makes travel transactions unique. Travel by nature is international, therefore so are the B2B payment flows that take place between travel buyers and suppliers as they bring consumer bookings to life. For this reason, pricing structure based on geography just doesn’t make sense. In addition, the manual processes that have historically supported these B2B payment flows weren’t keeping up with dynamic market needs. A lack of payment transparency and predictability was impacting liquidity.

What challenges were you looking to address with the solution?

Alternative payment methods typically have a lot of inefficiencies when it comes to facilitating global payment flows and unfortunately, they are still rife across B2B travel payment flows. These inefficiencies have left travel buyers and suppliers struggling with poor reconciliation, long settlement periods and a lack of payment protection for far too long.

Payment networks like Mastercard have the structure in place to handle global transactions more efficiently and securely. By leveraging our proven virtual card technology and embedding it into a B2B solution specifically designed for B2B travel transactions, we knew we could bring a solution to market that would benefit the entire travel value chain.

Back in 2015 when we first launched, we wanted the solution to increase B2B payment visibility and protection for the sector – little did we know just how essential these would become just a few years later. We’ve now enhanced the solution even further to meet the needs that the industry faces now, delivering enhanced flexibility through a more tailored product structure and removing the limitations of a pre-defined set of tiers.

How has the Mastercard Wholesale Program evolved?

The solution has always evolved based on industry feedback, back in 2019 we made lower product tiers available based on the needs of our partners. A lot has happened in the sector since then which is why we’ve again enhanced the solution based on industry feedback.

Flexibility is more important than ever, but we also heard that a more tailored approach to products was important to support specific market, volume and product types. So, we took action and have evolved the program to provide a more tailored structure.

Through the new enhancements, travel issuers will no longer need to set up dedicated BINs and account ranges to offer the different products to their customers. Going forward they will be able to easily convert the virtual card to a desired code or tier in real time through a simple API.

Relationships between travel intermediaries and banking partners are evolving, and now the Mastercard Wholesale Program is encouraging even closer collaboration to ensure that B2B payment solutions support all potential future growth.

What benefits does the evolved product bring to the travel industry?

The last few years have shown that the future health of the travel ecosystem relies on closer collaboration, which is why we have evolved the solution with the entire travel value chain in mind. Benefits for travel agencies, suppliers and issuers include:

- Flexibility;Issuers onboard once and Mastercard will develop a dynamic structure to support customer volumes.

- Control; Tailored tiers for different markets, currencies, and type of provider.

- Protection; Everyone across the travel value chain receives the standard card guarantee.

- Acceptance; Available to all travel issuers.

- Growth;Closer collaboration between supplier, buyer, and banking partner relationships realize mutually beneficial growth.

By simplifying implementation for travel issuers, the solution encourages greater participation which provides travel intermediaries with increased choice – ultimately supporting a more thriving travel economy.

As organisations across the travel sector look ahead to 2023, what should they be prioritising?

Consumers have emerged from a couple of years of restrictions with an appetite to travel, which gives travel organisations a lot to feel positive about. However broader economic pressures remain challenging and in times where inflation impacts operational costs as well as the traveller’s discretionary spend level, adaptability is key.

It’s critical that both travel agents and travel merchants adjust to these external pressures. Strong partnerships matter now more than ever so products that support this increased collaboration and provide mutually beneficial terms will drive the future health of the travel economy. This allows all parties to focus on realizing sales to grow their business.

The past two years have shown the ripple effect one fault can have across the value chain, and that the industry is only as strong as its weakest link. Growth is essential, but this must be sustainable which requires a reboot of the B2B payment strategies at the industry’s core. Only by laying firm foundations that enhance protection and increase flexibility across all travel transactions can the travel industry flourish for years to come.

To learn more about how the Mastercard Wholesale Program could benefit your organization, contact Rohnny directly on LinkedIn or the Mastercard’s B2B Travel team at [email protected]

Learn more about : Mastercard ( N. America ) Mastercard ( Asia Pecific ) Mastercard ( United Kingdom )

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

TAP Air Portugal to operate 29 flights due to strike on December 11

Qatar Airways offers flexible payment options for European travellers

Airbnb eyes a loyalty program but details remain under wraps

Air Mauritius reduces frequencies to Europe and Asia for the holiday season

Major rail disruptions around and in Berlin until early 2026