Mabrian data: Uneven air connectivity recovery in Oceania

Tourism to the Oceania region continues to bounce back from the pandemic, but is being stifled as air lift is not fully keeping up with demand.

Mabrian, the global travel intelligence platform, reveals promising travel intention trends from markets like the US India, China, and Europe, signalling potential growth for 2024 and beyond.

It says Oceania is facing an uneven recouping in air connectivity.

Mabrian shared its analysis with the World Travel & Tourism Council at the recent Perth Global Summit.

Oceania is formed by 14 countries (UN Statistics Board) grouped in four macro regions: Australia & New Zealand, Melanesia, Micronesia and Polynesia.

According to UN Tourism latest year-round data (2023), Oceania is close to reaching 2019 records.

How does 2024 and early 2025 looks like for Oceania, in terms of travel demand? Mabrian dug into two indicators: seats availability variation and scheduling to understand to what extent connectivity recovered after the pandemic, and Share of Searches Index for Oceania, based on flight searches for the first semester of 2024, to travel throughout 2024 and until late winter 2025.

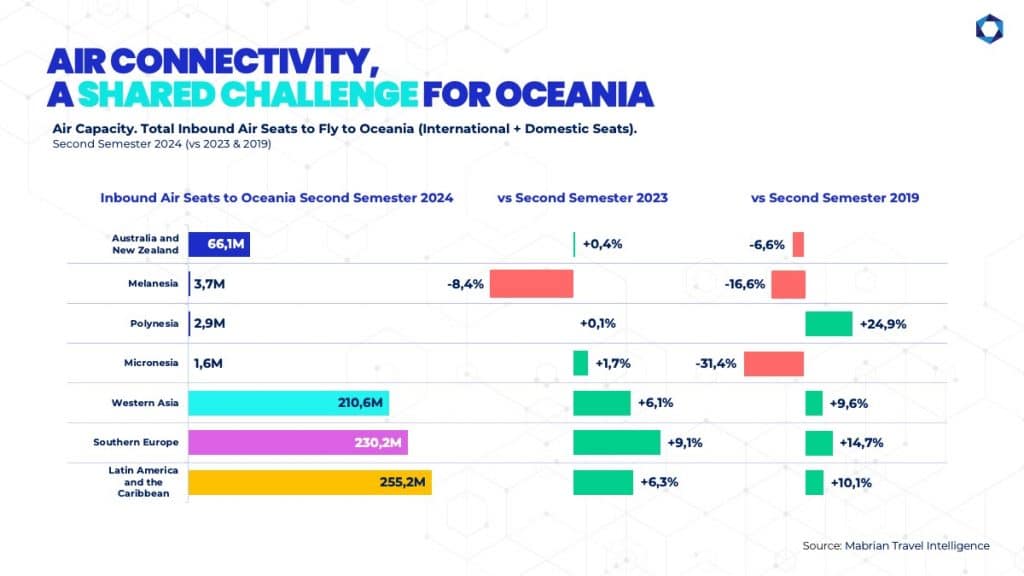

Air Connectivity, A Shared Challenge for Oceania

Due to its geography, Oceania is highly dependent on the air connectivity, domestic, regional, and international, so it is a crucial competitiveness factor for this continent.

According to Mabrian’s travel intelligence, overall regional connectivity to and within Oceania’s countries has not fully recovered after the pandemic.

When comparing scheduled inbound and domestic air seats for the second half of 2024 with 2019 same period, data shows that only Polynesia is 25% above 2019 figures.

“The path to recovery in terms of air capacity is slower when compared to other world regions, in particular some with a strong travel & tourism market, such as Southern Europe, Western Asia or Latin America”, said Carlos Cendra, Partner and Director of Marketing and Communications at Mabrian.

Focusing on inbound air seats to scheduled Oceania’s destinations for full year 2024 (compared to 2023 and 2019), Mabrian’s travel intelligence shows that air capacity recovery is progressive, and indicates an uneven recoup of air connectivity in the area favouring four destinations: Tahiti (French Polynesia), Nadi (Fiji), as well as Perth and the Sunshine Coast (Australia).

Tahiti (French Polynesia) increased +29% air seats availability compared 2019 and +1% growth compared to 2023; whereas, since 2019, Nadi (Fiji) grew +24% inbound air seats, +10% when compared to 2023.

When compared to full 2019, scheduled air seats indicate that inbound air connectivity is bouncing back +5% to Auckland (New Zealand), and +4% to both Queenstown (Australia) and to Port Moresby (Papua New Guinea). In fact, the capital of Papua New Guinea features a strong growing trend, as air seats’ availability increases +13% year over year.

Data illustrates the gap between travel intention and air connectivity.

This difference is particularly acute for Sydney and Melbourne (Australia), and also for Auckland (New Zealand), where global seats availability has not recovered yet to 2019 levels.

Inspirational demand to travel to Sydney during 2024 and until late winter 2025 from the United States, China or Europe tripled compared to the same period last year and increased 160% from India.

In the case of Melbourne, demand from India tripled, from Europe increased 121%, from China grew 158%, and almost 80% from the United States.

The appetite to visit New Zealand’s capital is also evident in these for markets.

“Oceania’s destinations must follow up on these demand trends as it offers clear hints on which are the opportunity markets to tap into to reinforce and rebuild air connectivity to the region.”

Related News Stories:

Related News Stories: Mabrian data: Uneven air connectivity recovery in Oceania Closing the gap between demand and connectivity, the key to ... Uncategorized – Page 18 – Welcome to Nardo Tours & Travels Travel demand to foreign destinations fom Paris increases 12 ... Uncategorized – Page 68 – Welcome to Nardo Tours & Travels UNWTO World Tourism Barometer and Statistical Annex, November ... Arabian Travel Market 2022 - Official Show Daily - Day 2 by ... Nico Stengel – Professor Tour Operator Management and Travel ... Full text of "Carpe Diem - Alumni Life, 2000-2004" Michaela Gregor – Metropolregion Hannover-Braunschweig ...

Learn more about : Mabrian Technologies ( Asia Pecific )

TravelMole Editorial Team

Editor for TravelMole North America and Asia pacific regions. Ray is a highly experienced (15+ years) skilled journalist and editor predominantly in travel, hospitality and lifestyle working with a huge number of major market-leading brands. He has also cover in-depth news, interviews and features in general business, finance, tech and geopolitical issues for a select few major news outlets and publishers.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

Qatar Airways adding Manchester flights

EU entry-exit system delayed again

ATC strike in Greece could disrupt flights this week

Jet2 unveils Samos as new Greek destination for summer 2026

Icelandair launches inaugural flight to Nashville