Preserving Travel Liquidity & Supporting Industry Growth with Virtual Cards

Author: Chiara Quaia, VP Travel Market Development, Mastercard

While COVID-19 has laid bare weaknesses across multiple industries, possibly the most significant impact has been seen in travel. As geographical restrictions were enforced and travelers adjusted their plans, consumers sought refunds and demanded more flexibility for future bookings. Consequently, over the past few months travel professionals have experienced firsthand the limitations of legacy travel payment processes.

Across the travel ecosystem bookings take place either through a direct or indirect model. Through the direct approach, consumers book directly with travel suppliers such as airlines, hotels and car rental companies. Through the indirect model, travel agencies book and facilitate payments on behalf of consumers and mostly either use the pass-through or merchant payment model, each with its own pitfalls. In pass-through, a travel intermediary, such as an online booking website, passes a consumer’s payment information to the various suppliers who then directly charge the consumers card. That information exchange creates opportunities for data to be compromised and also leads to confusion for consumers. While they may have spent time researching their preferred, trusted agency or online booking site they soon start to see a list of unknown merchants on their bank statement – leaving them to wonder who they have a relationship with and who to contact about their bookings.

Over recent years the merchant model, which has lower risks for all parties, has been gaining traction. Under this model, a travel agency acts as the sole consumer-facing merchant, taking full payment from a traveler and only then paying different suppliers from its own account. Typically, this model is facilitated by electronic transfer of cash using manual systems such as ACH, EFT and wires that can hinder accurate reconciliation and leave travel agencies exposed when crisis hits. Through this model travel agencies are at higher risk following supplier default, which has come to the fore in recent months. While COVID-19 has amplified this issue, it isn’t new, since 2002 losses due to airline default have reached more than $100 billion.

Today, agencies using the merchant model and relying on manual payment solutions are on even shakier financial ground. Since many promptly repaid consumers for cancelations, but have yet to be refunded for their own expenditures on those canceled trips, they have no protection. This has put unprecedented strain on the entire travel ecosystem which has been operating on increasingly tighter margins.

It is not hard to see the legacy friction points that have been exacerbated by the global pandemic. Now is the time to take a fresh look at what has historically held the industry back in order to not only preserve and recover, but grow stronger than before. We have the collective opportunity to choose a more agile and robust path in order to realize a more resilient new normal for the entire travel industry.

What steps can we take to achieve this? A new focus on standardized, digital payment flows is key.

By nature the travel industry is global and cross border yet transactions have been historically characterized by fees that differ whether payments are domestic, inter-regional or international. Travel intermediaries and suppliers serve consumers from across the globe so transaction pricing based on geography is not fit for purpose.

For all to emerge stronger what is needed is greater payment predictability, enhanced flexibility and increased protection. None of which is achieved through manual processes such as invoiced payments and traditional bank transfers.

One digital payment solution that is well placed to address legacy B2B travel payment barriers is virtual cards. Virtual cards are fully PCI compliant and provide a secure way to conduct travel payments. They’re also a proven option, with steady uptake pre-COVID they already had a market size of $148 billion in 2018.

Virtual cards are random, digitally-generated card numbers linked to a base account. They’re accepted everywhere traditional cards are taken, have enhanced purchase protection via card payment guarantee, and increased security through unique numbers that are used for each transaction. Mastercard has been pioneering virtual cards for travel transactions for a number of years, we’re already working with 360,000+ travel providers across 200+ countries.

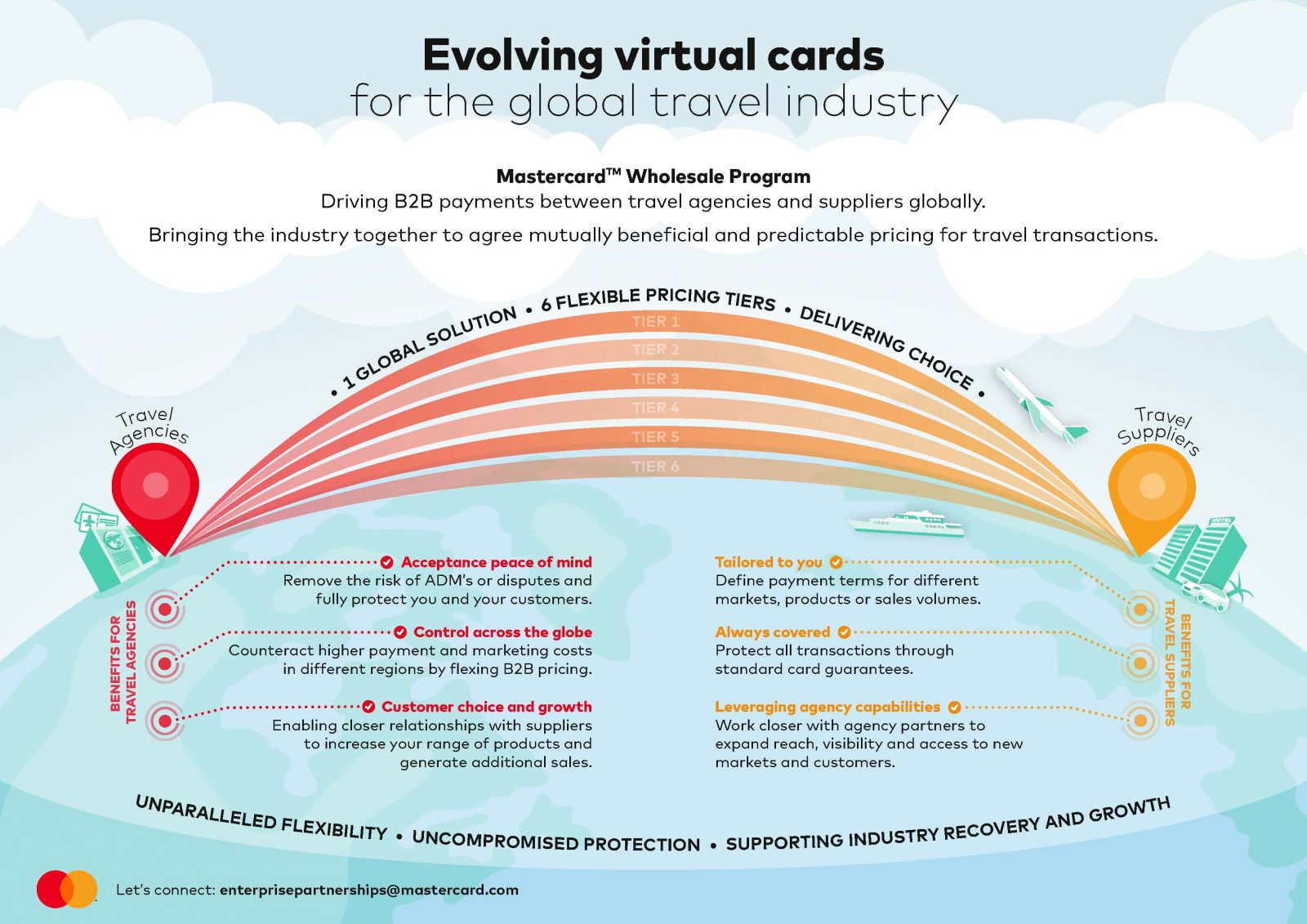

Mastercard’s Wholesale Program, which expanded today to offer more flexibility to travel buyers and suppliers through additional pricing tiers, provides a predictable set of mutually beneficial economics to players across the industry. The Program provides a set payment structure, which isn’t impacted by geography and is specifically limited to merchants within the travel industry, and our expanded product tiers can be used for different commercial arrangements. Agents and suppliers can choose which product suits them best and have total flexibility to agree terms.

For travel agencies, virtual cards help them mitigate operational inefficiencies while preserving liquidity and providing payment protection for themselves and their customers. With automatically generated numbers virtual cards provide a link between each booking, individual payment and associated suppliers which not only supports reconciliation but, should the worst happen, facilitates accurate and timely refunds by clarifying interactions between travelers, agencies and experience providers.

For travel suppliers, card payment guarantees mean that they have greater peace of mind. When being paid by virtual card from a travel agent, suppliers such as airlines and hotels know that as soon as payment is authorized they have a payment guarantee. While the industry has a legacy of long settlement periods (30+ days), virtual cards support payment on a transaction-by-transaction basis and settlement typically occurs every 2-3 days. In addition, the flexible pricing tiers make it easier to establish dynamic relationships, working in collaboration with travel agencies to expand reach and visibility – ultimately better serving consumers seeking new and unique experiences.

The pace of digitization will only accelerate now that the global pandemic has exposed how little protection legacy payment solutions offer the industry. A more robust future for the entire ecosystem is one that delivers greater flexibility, supports liquidity and mitigates risk.

As the travel ecosystem adjusts to a new normal and we come together to not only preserve the industry but fuel growth, let’s take the opportunity to ensure that the new normal we are working towards is one that is stronger than before. That’s a journey Mastercard is proud to be part of. As organizations across the industry navigate the challenges they face we remain firmly by their side, ensuring that payment innovation is doing its part in laying firm foundations for a future that supports resiliency and growth.

To hear more about how Mastercard is partnering across the travel industry please contact Chiara Quaia and the B2B Travel team at [email protected].

To hear more about how Mastercard is partnering across the travel industry please contact Chiara Quaia and the B2B Travel team at [email protected].

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

BA suspending all Heathrow to Abu Dhabi flights

Turkish Airlines flight in emergency landing after pilot dies

Unexpected wave rocks cruise ship

Woman dies after going overboard in English Channel

Foreign Office issues travel advisory for winter sun destinations