We were born on the verge of technology and travel. We develop SaaS products and services for the tourism industry and beyond. We grow digital travel.

Taking a step further, we pre-empt, envision & develop solutions that shape the future of all our customers, not only in travel. We grow digital commerce.

We believe in the growing global community and the importance of its interconnectivity. We actively seek to connect businesses through tech platforms, paving the road for sustained growth and a shared global vision. Our partners capitalise on all the global possibilities.

We are a family. A growing family of passionate people with a “will do” attitude, who clearly define our objectives and plot the optimal path to achieve them. Through specialization, hard work and passion, each of us delivers what he/she does best, and together, we are a lean, unstoppable developing machine.

-

03 Nov 22

Partner News

ANIXE – Travel Market Trends 2022.11 Get used to growth as pandemic impact is negatedThis summer's high season came about with great expectations. Finally free from the pandemic, ...Read moreANIXE – Travel Market Trends 2022.11 Get used to growth as pandemic impact is negated - News & announcementsThis summer's high season came about with great expectations. Finally free from the pandemic, tourists with pent-up aspirations of travel were to bring us roaring back to the pre-pandemic golden age levels of bookings. Well, to the surprise of our industry’s pessimists, those expectations became a reality. September's booking figures indicate that we are back to, and in some markets, have already exceeded 2019's high watermark. But, before we take a look at our data, let’s see what’s happening in the industry as a whole, and whether the implications match our optimism. Signs of a return to normalcy can be seen all over the travel industry. For example, airlines worldwide plan to expand capacity to meet current demand. At the ALTA Leaders Forum in Buenos Aires, the CEOs of Latin America's major airlines painted a positive outlook. Roberto Alvo, the CEO of Latam Airlines Group - the region's largest, stated, "We are at a period of strong recovery of [the] industry,". And Avianca CEO Adrian Neuhauser added, "We are working to add capacity because it is an over-demanded market nowadays". Further figures from South America, provide proof that the travel industry has not only recovered, but has started to grow. Passenger counts in Mexico and Columbia have already exceeded pre-pandemic numbers, with total passenger increases of 14% and 9%, respectively. At least in some parts of the world, it seems that COVID is now a distant memory. And it is not only in Latin America where we can see airline chiefs with huge smiles on their faces. Emirates president Tim Clark describes flights as being "full-up" as far out as March and that he sees a "capacity hole" that, due to staffing issues and maintenance, the company cannot fill in the short term. Nevertheless, Emirates expects to have its full fleet up and flying by next summer. The sentiments of Emirates' president are also parroted by the CEOs of Lufthansa, Air France-KLM, Delta Airlines and American Airlines, who are now in a race to increase capacity to meet the demand of would-be travellers. Under-capacity could be good news for said travellers as it means that high prices are not only a consequence of the global cost-of-living crisis but also due to the under-capacity of airlines. However, with airlines planning to have their full fleets back in the air as soon as possible, we will likely see price reductions going into the second quarter of 2023 as supply catches up with demand. Great news if you’re planning a summer 2023 getaway. Elsewhere in the industry things are looking up too. On Tuesday, Airbnb recorded its highest-ever income and profit in the 3rd quarter of 2022. An increase in demand catapulted the company's net income by 46% compared to last year's figures for the same quarter. Furthermore, the 2022 U.S. Family Travel Survey, released last Wednesday, shows that a massive 85% of American parents plan to travel with their children in the next 12 months. So, although high inflation will undoubtedly continue to affect travel demand, we might say that, due to lockdowns and restrictions, travel products are becoming economically quasi-inelastic, where demand remains the same even as prices go up. Great news for travel industry players! And the good news just keeps rolling in; our own data shows that this recovery isn’t just isolated to certain parts of the industry but is something we are seeing across the board. So, without further ado, let's look into our data gathered from the Resfinity Booking engine to see if what we see in other parts of the industry is reflected by the reality of our own numbers. The good fortune and trend of recent months, continuing even outside the holiday season, prove that travellers are no longer concerned about the pandemic. Instead, we are travelling as before, and demand fluctuations correspond to similar monthly fluctuations as before the pandemic. Recent months fit this thesis perfectly. October 2022 generated a nearly 12% drop in bookings relative to late September. However, their volume represented 97.5% of October 2019 levels globally and as high as 106% in the German market. It is excellent news but somewhat of a surprise given the current energy crisis and the ongoing war in Ukraine. In October 2022, German travellers went mainly to domestic destinations, Turkey, the US and Spain. Although still at a high level, the latter's share of reservations scores a significant decline both monthly and annually. We also recorded large declines in other vacation destinations such as Italy and Greece. In contrast, we recorded large increases in demand for trips to Egypt, which is already overbooked in major resorts through till the end of November.

In October 2022 - for the first time in many months - Spanish resorts gave way to Antalya, noting a drop in bookings of close to 40% but remaining the second most popular destination for the month. Hurghada in Egypt was also very popular, as were several German destinations, including Berlin, Frankfurt, Hamburg, Munich and Cologne.

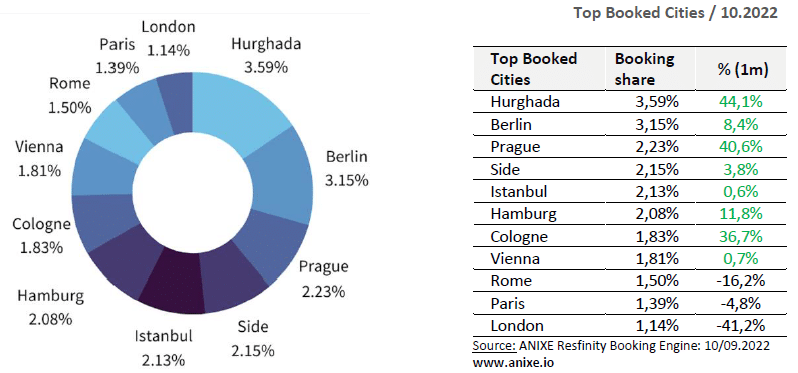

The most popular destinations in October 2022 were Hurghada, Berlin, Prague and two popular Turkish resorts: Side and Istanbul. On a monthly basis, Hurghada and Prague, in particular, enjoyed about a 40% increase in popularity. For Prague, this growth is more impressive compared to the period before the pandemic - its increase in the share of reservations is about 32%.

Before the pandemic, Berlin and Hurghada were also the most popular among German tourists during the same period. Rome was also in the top 5 then, although its popularity has dropped by more than 16% in the last month.

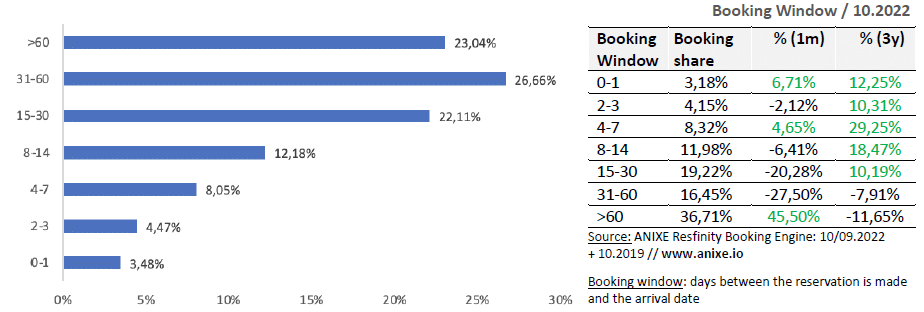

In October 2022 - just like three years ago - interest in early booking offers (31-60 days or more) dominated, rising by as much as 45% from last month! This may be closely linked to New Year's Eve bookings and ski resorts that German tourists are so fond of.

Interestingly, it is evident that the uncertainty of the current times has receded into the background, that interest in these offers is growing rapidly. However, the pandemic experience of recent periods shows that autumn and winter are only conducive to travel planning if offers include the possibility of free cancellation.

In October 2022, German travellers went mainly to domestic destinations, Turkey, the US and Spain. Although still at a high level, the latter's share of reservations scores a significant decline both monthly and annually. We also recorded large declines in other vacation destinations such as Italy and Greece. In contrast, we recorded large increases in demand for trips to Egypt, which is already overbooked in major resorts through till the end of November.

In October 2022 - for the first time in many months - Spanish resorts gave way to Antalya, noting a drop in bookings of close to 40% but remaining the second most popular destination for the month. Hurghada in Egypt was also very popular, as were several German destinations, including Berlin, Frankfurt, Hamburg, Munich and Cologne.

The most popular destinations in October 2022 were Hurghada, Berlin, Prague and two popular Turkish resorts: Side and Istanbul. On a monthly basis, Hurghada and Prague, in particular, enjoyed about a 40% increase in popularity. For Prague, this growth is more impressive compared to the period before the pandemic - its increase in the share of reservations is about 32%.

Before the pandemic, Berlin and Hurghada were also the most popular among German tourists during the same period. Rome was also in the top 5 then, although its popularity has dropped by more than 16% in the last month.

In October 2022 - just like three years ago - interest in early booking offers (31-60 days or more) dominated, rising by as much as 45% from last month! This may be closely linked to New Year's Eve bookings and ski resorts that German tourists are so fond of.

Interestingly, it is evident that the uncertainty of the current times has receded into the background, that interest in these offers is growing rapidly. However, the pandemic experience of recent periods shows that autumn and winter are only conducive to travel planning if offers include the possibility of free cancellation.

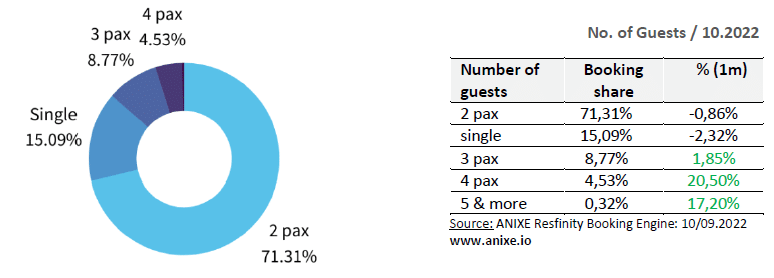

Another month in a row confirms the trend showing the profile and group size of the average traveller—groups of 2 people and singles dominate. Yet, surprisingly, the share of single bookings in October 2022 was 9% lower than in October 2019. Certainly, the unabated popularity of remote work and reduced business travel played a role.

Another month in a row confirms the trend showing the profile and group size of the average traveller—groups of 2 people and singles dominate. Yet, surprisingly, the share of single bookings in October 2022 was 9% lower than in October 2019. Certainly, the unabated popularity of remote work and reduced business travel played a role.

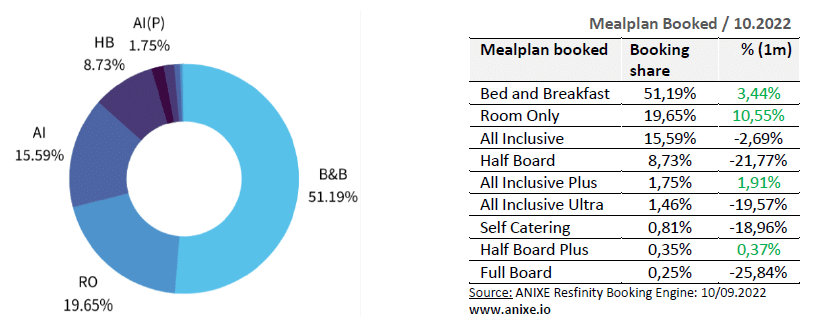

ANIXE's travel industry data from our Resfinity booking engine shows that a large share of 1-2 person trips correlates with the overwhelming popularity of rooms with breakfast and rooms without meals. However, the latter's percentage, despite increasing by 10% monthly, remains 17% lower than in the same period before the pandemic.

ANIXE's travel industry data from our Resfinity booking engine shows that a large share of 1-2 person trips correlates with the overwhelming popularity of rooms with breakfast and rooms without meals. However, the latter's percentage, despite increasing by 10% monthly, remains 17% lower than in the same period before the pandemic.

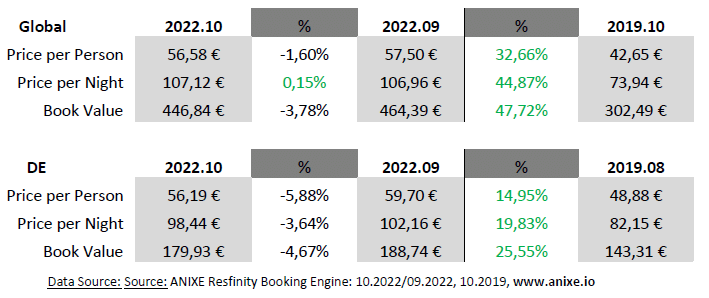

As far as prices are concerned, after the holiday season, when demand and prices for hotel services are highest, small average decreases are noticeable, especially in the German market, reaching up to nearly 6% per person. Nevertheless, compared to the pre-pandemic period, current average prices are significantly higher by up to 15% per person or 20% per night. Globally, this disparity is even more significant, and the difference is twice that of the German market.

On the one hand, this is due to the hotel sector's desire to make up for post-pandemic losses. Still, on the other hand, creeping inflation is weighing down the European economy and significantly affecting price changes.

As far as prices are concerned, after the holiday season, when demand and prices for hotel services are highest, small average decreases are noticeable, especially in the German market, reaching up to nearly 6% per person. Nevertheless, compared to the pre-pandemic period, current average prices are significantly higher by up to 15% per person or 20% per night. Globally, this disparity is even more significant, and the difference is twice that of the German market.

On the one hand, this is due to the hotel sector's desire to make up for post-pandemic losses. Still, on the other hand, creeping inflation is weighing down the European economy and significantly affecting price changes.

The holiday season brought the expected recovery to the tourism market. The positive trend has been in place for many months, responding to demand changes like before the pandemic. It could be said that we have learned to travel despite everything, which from the perspective of travel companies, is excellent news.

Unfortunately, high global inflation compounded by the war in Ukraine and the food and energy crises may increasingly disrupt this idyllic picture of the tourism market. Also ahead is the autumn-winter period - i.e., the exacerbation of pandemics.

How much will these factors be reflected in the tourism market dynamics in the coming months? Will the pandemic prevent us from going to some change resorts again? Which destinations will prove to be a hit that will resist the recession? To find out, follow your reliable source of travel industry trends; ANIXE Insights.

Stay tuned. Stay safe. Plan your trips.

Team ANIXE

The holiday season brought the expected recovery to the tourism market. The positive trend has been in place for many months, responding to demand changes like before the pandemic. It could be said that we have learned to travel despite everything, which from the perspective of travel companies, is excellent news.

Unfortunately, high global inflation compounded by the war in Ukraine and the food and energy crises may increasingly disrupt this idyllic picture of the tourism market. Also ahead is the autumn-winter period - i.e., the exacerbation of pandemics.

How much will these factors be reflected in the tourism market dynamics in the coming months? Will the pandemic prevent us from going to some change resorts again? Which destinations will prove to be a hit that will resist the recession? To find out, follow your reliable source of travel industry trends; ANIXE Insights.

Stay tuned. Stay safe. Plan your trips.

Team ANIXE -

09 Feb 22

Partner News

ANIXE Insights 2022.02: Seven Weeks of Continuous, Sustained Growth!We’re slowly approaching the year 2 PC (Post Covid). The New Norm media channels spoke ...Read moreANIXE Insights 2022.02: Seven Weeks of Continuous, Sustained Growth! - News & announcementsWe’re slowly approaching the year 2 PC (Post Covid). The New Norm media channels spoke of is no longer a notion, or the idea of a possible future for the sustained existence of humanity; it’s something we live and breathe every day. The smell of your polyester or cloth mask. Feeling your breath create small beads of precipitation and perspiration around your mouth and nose. Taking a step back if your buddy gets too excited in a conversation and steps forward. Rubbing your hands vigorously with alcohol after an hour at the supermarket. These have all become second nature for most of us. Like driving a car. The New Norm has ingrained a new set of rules in our minds, that now sit in our subconscious and dictate the extent and boundaries of our actions, even before we attempt each one. We’ve been reconditioned with built in pre-emptive measures that are intended to help us survive; to help us live side by side with Covid and manage to lead somewhat normal lives. After all, the show must go on. As we’ve concluded previously the general population is becoming more mentally resilient by the day, and the virus has given us a helping hand. Omicron may be what we’ve all been waiting for. A super infections strain of Covid that is incredibly mild; which in the words of a doctor is what the medical establishment has been trying to simulate with the global vaccination programs. In short, Omicron appears to be a blessing from the heavens and could be the end of all this madness. And people are loving it! That thesis is confirmed by reports from the Resfinity Booking Engine on the number of inquiries and bookings made by a considerable group of the world's largest tour operators and online travel agencies.January 2022 was a month of dynamic rebound after December 2021, which was the epicenter of the impact of the 5th wave of the Covid pandemic. Of course, the market didn't shake out, but its travel production volume was down to 22% of December 2019. Fortunately, the new year brought a wind of much needed positive change and market recovery. The global markets speeded up, climbing to around 42% of January 2020. Turnover is starting to build up, and it's only the beginning of the year.

Since February 1st, new travel recommendations from the Council of the European Union have been in effect in EU countries. The new recommendations stipulate that the criterion for imposing additional obligations on visitors should be based on the status of the person traveling, rather than where they come from. In practice, this means that the fully vaccinated and the recovered are to travel more freely in the community. Amazing news! The unvaxxed on the other hand, can show their PCR test results. Nevertheless, the final decision on entry regulations lies with the individual countries. Some of them, such as Italy, have already adjusted their border-crossing rules to the new recommendations.

The source of the growing demand for travel abroad can be attributed to several factors: the above-mentioned drive of the European Union to introduce and update regulations facilitating safe and free movement in the countries of the community, sanitary protocols established by the governments of individual countries, the increasing availability of vaccinations - including the third dose for teenagers, as well as the adjustment of tour operators' offers to the current situation. Customers of travel agencies can change the date of departure for free, even dozens of days before the trip, or buy travel insurance that includes coverage against COVID-19. All this makes European tourists not only more confident in booking - even months in advance to take advantage of discounts and promotions - but also more stable in their purchasing decisions. The industry’s support of holiday planners in the form of numerous guarantees to the end consumer gives everyone a sense of security, and customers are much less likely to look for opportunities to make changes to their bookings than just a few weeks ago.

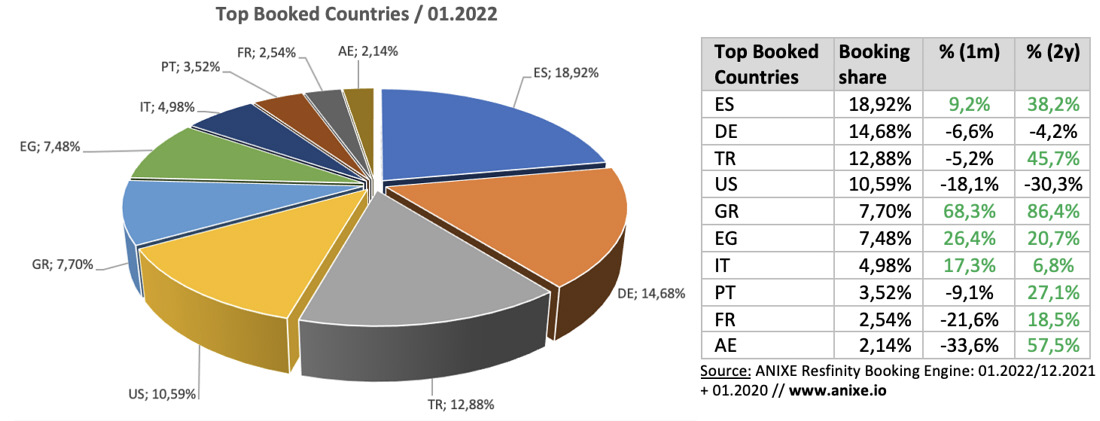

In January 2021, Germans targeted Spain, Turkey and local destinations. The former in particular was very popular, and its share increased significantly both on a monthly basis (9%) but especially compared to January before the pandemic (38%).

Interestingly, the share of holiday destinations such as Greece, Turkey and Egypt remained significantly higher than in the corresponding period in 2019 and from a monthly perspective. However, the same can’t be said for local spots, who although maintain high participation, have lower dynamics than in previous periods.

Since February 1st, new travel recommendations from the Council of the European Union have been in effect in EU countries. The new recommendations stipulate that the criterion for imposing additional obligations on visitors should be based on the status of the person traveling, rather than where they come from. In practice, this means that the fully vaccinated and the recovered are to travel more freely in the community. Amazing news! The unvaxxed on the other hand, can show their PCR test results. Nevertheless, the final decision on entry regulations lies with the individual countries. Some of them, such as Italy, have already adjusted their border-crossing rules to the new recommendations.

The source of the growing demand for travel abroad can be attributed to several factors: the above-mentioned drive of the European Union to introduce and update regulations facilitating safe and free movement in the countries of the community, sanitary protocols established by the governments of individual countries, the increasing availability of vaccinations - including the third dose for teenagers, as well as the adjustment of tour operators' offers to the current situation. Customers of travel agencies can change the date of departure for free, even dozens of days before the trip, or buy travel insurance that includes coverage against COVID-19. All this makes European tourists not only more confident in booking - even months in advance to take advantage of discounts and promotions - but also more stable in their purchasing decisions. The industry’s support of holiday planners in the form of numerous guarantees to the end consumer gives everyone a sense of security, and customers are much less likely to look for opportunities to make changes to their bookings than just a few weeks ago.

In January 2021, Germans targeted Spain, Turkey and local destinations. The former in particular was very popular, and its share increased significantly both on a monthly basis (9%) but especially compared to January before the pandemic (38%).

Interestingly, the share of holiday destinations such as Greece, Turkey and Egypt remained significantly higher than in the corresponding period in 2019 and from a monthly perspective. However, the same can’t be said for local spots, who although maintain high participation, have lower dynamics than in previous periods.

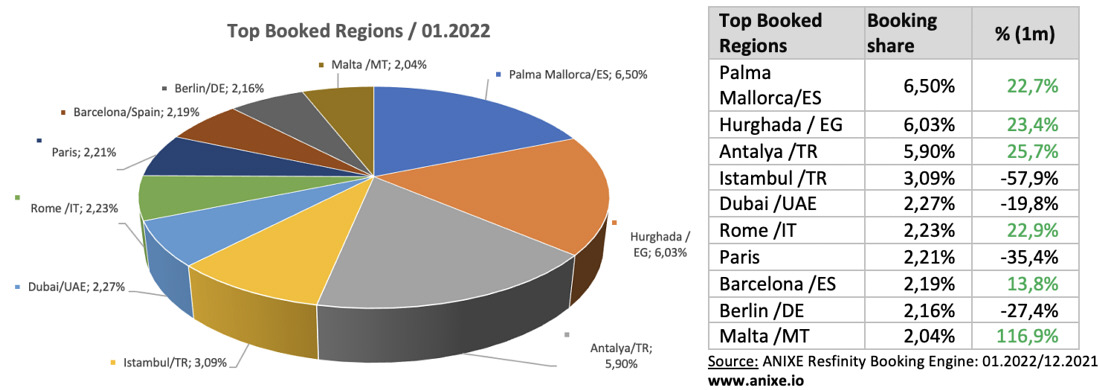

The first days of the new year have encouraged German travellers to make reservations for Spain's Palma Mallorca, Egypt's Hurghada and Turkey's Antalya, which showed an increase in popularity of over 22%. Unfortunately, this cannot be said for local destinations or big-city routes such as Istanbul, Dubai and Paris, whose share has seen significant falls compared to the end of 2021.

Likewise, the list lacked top-rated destinations in January 2020 - Las Vegas, New York and London. Their share in 2022 - despite its still high position - fell by 25% for the first two regions and by almost 70% for the last one place.

The first days of the new year have encouraged German travellers to make reservations for Spain's Palma Mallorca, Egypt's Hurghada and Turkey's Antalya, which showed an increase in popularity of over 22%. Unfortunately, this cannot be said for local destinations or big-city routes such as Istanbul, Dubai and Paris, whose share has seen significant falls compared to the end of 2021.

Likewise, the list lacked top-rated destinations in January 2020 - Las Vegas, New York and London. Their share in 2022 - despite its still high position - fell by 25% for the first two regions and by almost 70% for the last one place.

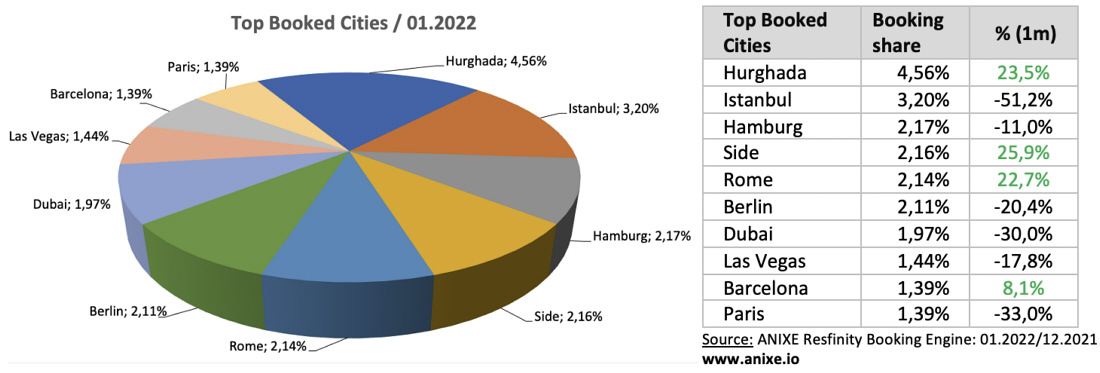

The two most popular destination cities in January 2022 for German travellers are Hurghada and Istambul. In particular, the Egyptian resort saw a significant 202% increase in popularity, as did Side and Rome, although their share of bookings was ultimately not as spectacular.

Compared to the situation two years ago, i.e.January 2020 - the most significant increase in holiday popularity was especially seen also in Istambul and Hurghada. On the other hand, the most considerable decrease in the share of 10 top-rated destinations of the Resfinity Booking Engine 01.2020 was in Vienna, London and… Berlin.

It looks like less ski trips and more beach getaways this winter.

The two most popular destination cities in January 2022 for German travellers are Hurghada and Istambul. In particular, the Egyptian resort saw a significant 202% increase in popularity, as did Side and Rome, although their share of bookings was ultimately not as spectacular.

Compared to the situation two years ago, i.e.January 2020 - the most significant increase in holiday popularity was especially seen also in Istambul and Hurghada. On the other hand, the most considerable decrease in the share of 10 top-rated destinations of the Resfinity Booking Engine 01.2020 was in Vienna, London and… Berlin.

It looks like less ski trips and more beach getaways this winter.

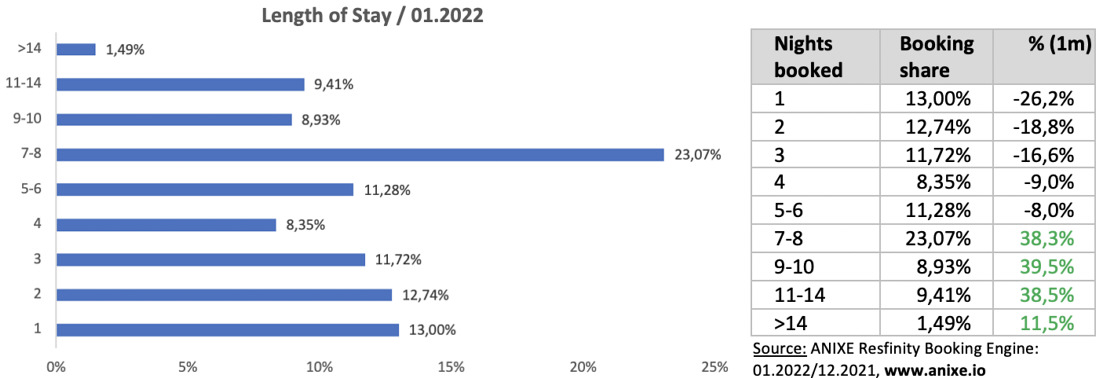

German travelers have enjoyed trips lasting about a week for the past six months. The epicenter of the 5th wave outbreak and the upcoming winter holidays has decreased the popularity of shorter trips. Its not a typical situation considering that just two years ago, in the first month of 2020, the most popular trips among German tourists were one-day (20%) and two-day routes (16.2%).

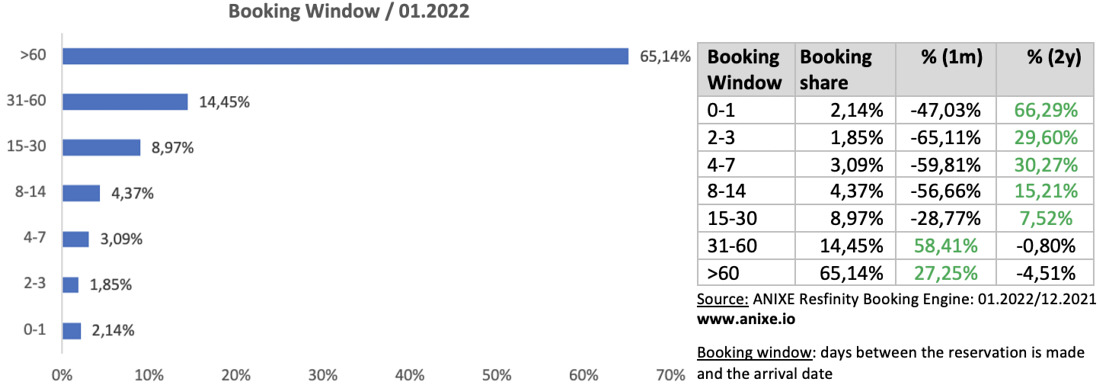

In January 2022 - just like two years ago - interest in early booking offers (over 60 days) is dominant, relegating bookings made 0-4 weeks in advance. In the last period, this trend was confirmed, and people eagerly made their reservations, feeling confident to plan travel in a safer post-pandemic world and opting to wait for warmer climates.

In fact, the booking curve we see this year almost looks normal. Fingers crossed!

German travelers have enjoyed trips lasting about a week for the past six months. The epicenter of the 5th wave outbreak and the upcoming winter holidays has decreased the popularity of shorter trips. Its not a typical situation considering that just two years ago, in the first month of 2020, the most popular trips among German tourists were one-day (20%) and two-day routes (16.2%).

In January 2022 - just like two years ago - interest in early booking offers (over 60 days) is dominant, relegating bookings made 0-4 weeks in advance. In the last period, this trend was confirmed, and people eagerly made their reservations, feeling confident to plan travel in a safer post-pandemic world and opting to wait for warmer climates.

In fact, the booking curve we see this year almost looks normal. Fingers crossed!

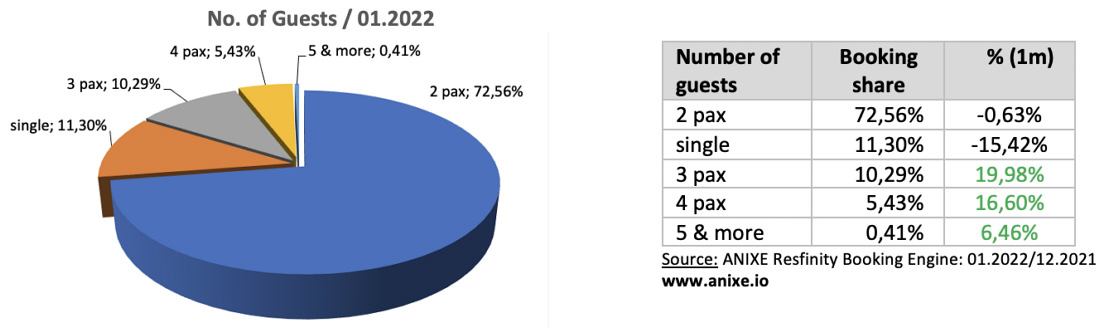

The trend showing the profile and size of the statistical group of travellers is also confirmed. Current indications are roughly in line with those from 2 years ago. Dominating are groups of 2 people and singles. Surprisingly, the share of single bookings in January 2022 was 15,4% lower than in December 2021 and 12,3% lower than in January 2020. Coronavirus restrictions certainly played a significant role in this.

The trend showing the profile and size of the statistical group of travellers is also confirmed. Current indications are roughly in line with those from 2 years ago. Dominating are groups of 2 people and singles. Surprisingly, the share of single bookings in January 2022 was 15,4% lower than in December 2021 and 12,3% lower than in January 2020. Coronavirus restrictions certainly played a significant role in this.

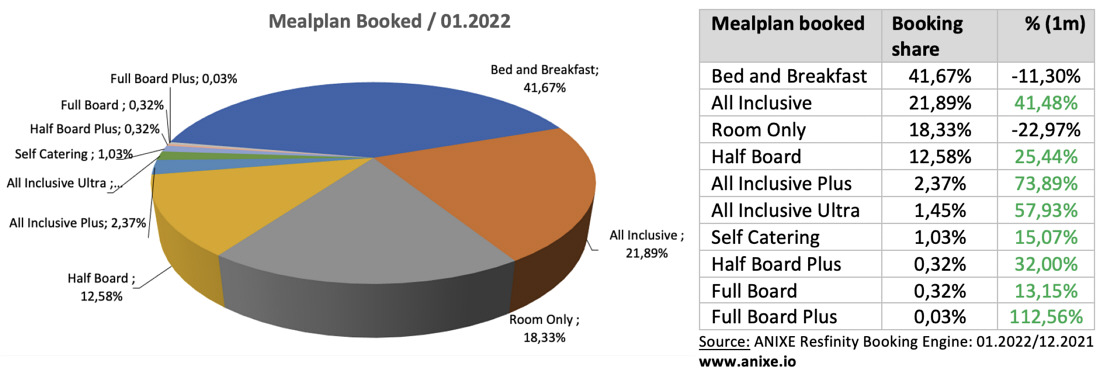

ANIXE's Resfinity travel industry data shows that the decrease in business travel (single trips) is matched by the fall in the popularity of rooms with breakfast only or even no meals. It also reflects the situation in the same period before the pandemic, where the popularity of rooms in the HB (Half Board) and AI (All-Inclusive) was significantly lower than it is now - accordingly by 60% and 30%.

ANIXE's Resfinity travel industry data shows that the decrease in business travel (single trips) is matched by the fall in the popularity of rooms with breakfast only or even no meals. It also reflects the situation in the same period before the pandemic, where the popularity of rooms in the HB (Half Board) and AI (All-Inclusive) was significantly lower than it is now - accordingly by 60% and 30%.

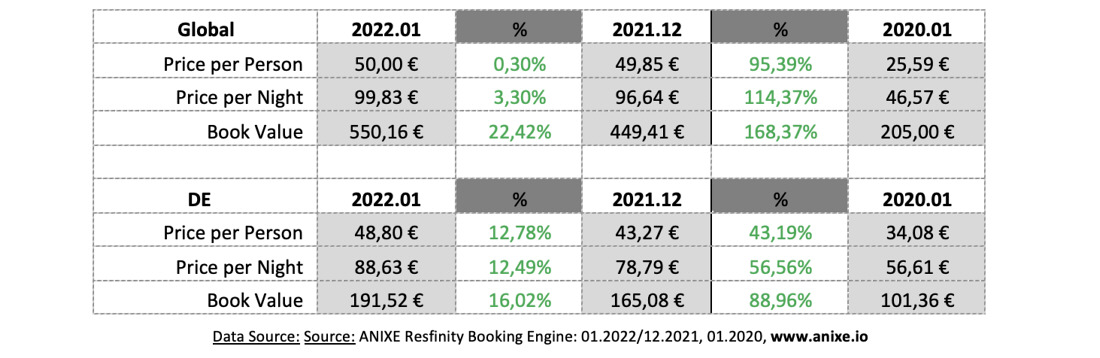

As far as prices are concerned, after some pandemic price drops in Dec. 2021, hotel prices started to increase - both on a monthly and biannual basis. On the one hand, this is the effect of the hotel sector's desire to make up for losses as prices respond to changes in demand. Additionally, on the other hand, the high level of inflation, which is weighing on both European and global economies, can significantly impact price differences in a two-year perspective. It all adds up to a picture of rising prices in the market, which can do little to dampen the overwhelming demand for package holidays.

As far as prices are concerned, after some pandemic price drops in Dec. 2021, hotel prices started to increase - both on a monthly and biannual basis. On the one hand, this is the effect of the hotel sector's desire to make up for losses as prices respond to changes in demand. Additionally, on the other hand, the high level of inflation, which is weighing on both European and global economies, can significantly impact price differences in a two-year perspective. It all adds up to a picture of rising prices in the market, which can do little to dampen the overwhelming demand for package holidays.

It seems the new year has opened a new chapter in our lives, and a hot new season for the travel industry. Its brought us many positive indicators for the coming months thus far. It looks like its going to be a good spring season for travel, which encourages us all to make our travel plans for the coming months. There are many indications that we’ll be able to realize many of our postponed plans this year and finally go on that much awaited getaway!

Will this positive dynamic and impressive growth trend continue? We sure hope so! What destinations will be the top sellers for Spring 2022? Will availability become an issue this summer?! Really?! Well, to find out, please stay tuned to your single source of reliable travel trends and statistics – ANIXE Insights.

Stay tuned. Stay safe. Plan your trips.

Team ANIXE

(Data origin: ANIXE Resfinity Booking Engine. Data originated from the ANIXE Resfinity IBE travel system.)

It seems the new year has opened a new chapter in our lives, and a hot new season for the travel industry. Its brought us many positive indicators for the coming months thus far. It looks like its going to be a good spring season for travel, which encourages us all to make our travel plans for the coming months. There are many indications that we’ll be able to realize many of our postponed plans this year and finally go on that much awaited getaway!

Will this positive dynamic and impressive growth trend continue? We sure hope so! What destinations will be the top sellers for Spring 2022? Will availability become an issue this summer?! Really?! Well, to find out, please stay tuned to your single source of reliable travel trends and statistics – ANIXE Insights.

Stay tuned. Stay safe. Plan your trips.

Team ANIXE

(Data origin: ANIXE Resfinity Booking Engine. Data originated from the ANIXE Resfinity IBE travel system.) -

12 Nov 21

NEWS

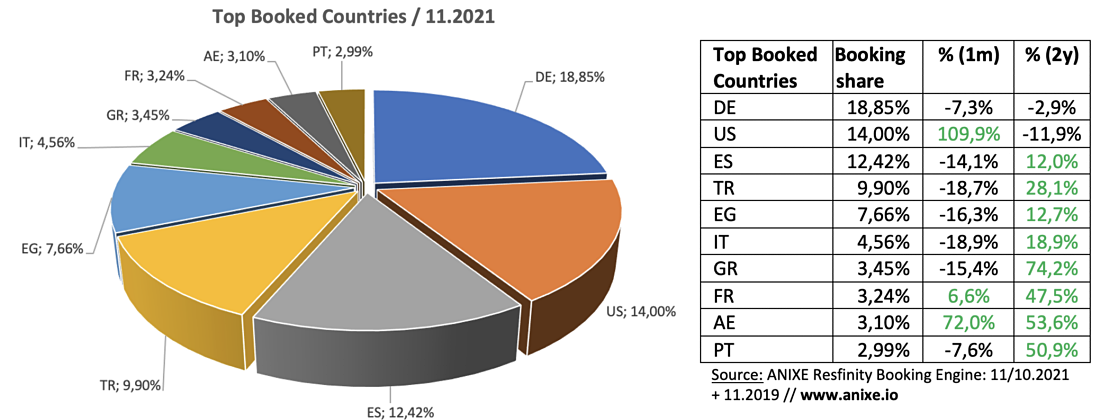

ANIXE Insights: Significant downtrend in bookings. COVID restrictions negatively affect the tourism sector2021 has been a year of consistent recovery for the travel industry, with the exception ...Read moreANIXE Insights: Significant downtrend in bookings. COVID restrictions negatively affect the tourism sector - News & announcements2021 has been a year of consistent recovery for the travel industry, with the exception of some notable dips in the curve. At the onset of new waves, variants and travel restrictions we’ve seen countries go from red to green and back to red. We’ve seen a largely last-minute trend where people feel more confident in making travel decisions almost on the go. If the news says things are under control, then better travel now before that changes. That’s what many of us have done. We’ve managed to get away with some weeks at the beach with our families and friends, and with vaccination programs underway globally we assumed it would be all downhill from that point onward. Many of us have booked Christmas and New Year getaways and find ourselves now wondering if we’ll eventually have to cancel our plans. The Omicron variant. Addressing the elephant in the room, we must consider a few important factors we have observed. It’s not all bad. • Although the media is making Omicron out to be the biggest, baddest variant of all time, less and less people are worried about it. We know because the search traffic hasn’t receded at all. To the contrary, it would appear to have grown a bit as people search frantically for destinations still open to travel. • Although booking volumes for December shrunk to around 40% of the numbers we saw sold in October 21, cancellations aren’t coming in, contrary to the situation with the last set of lockdowns. The conclusion here is the same. People aren’t afraid to travel. They’re not going to cancel their trips, not unless they have to. • Winter is coming. In many places around the world, we’re smack in the middle of it. The virus is likely to become more active and people are willing to wait it out. Winter destinations like Egypt, Dubai and the Canary Islands may suffer due to this, but summer destinations should be ok, as the virus is expected to die down by then. To conclude, the drop in booking volume we see today may not be just COVID related but may rather reflect a new travel trend. People will opt to stay home in the winter or travel locally but must have that summer beach getaway with the family. It may end up being the main vacation type of the future…beach & sun. The one you aren’t prepared to give up. As the global population lines up for their third vaccine boosters, they search intently for their summer getaway hoping to catch amazing early booking prices, with lax cancellation policies. And they will. We’ve become a lot more resilient in the last two years and we’ve also become used to this new threat that we constantly live with. It’s become like the flu’s evil cousin that we’re getting accustomed to. A lot more of us are vaccinated today even if we are globally still behind projections, and we feel a lot more confident with our chances against covid because of that. We believe that although this winter will be tough, we will live to see better days shortly after. October 2021 was another month of good fortune for the travel sector with another monthly average 5.4% increase in bookings - which was a big deal given the continued growth despite the long overdue holidays. The global market was climbing to around 86% of the October 2019 volume, and in Germany, activity levels started to maintain even the 87% levels of hotel bookings. Unfortunately, November 2021 reversed this positive trend for the travel sector. Dynamics fell hard, by over 40%, stopping at around 52% of November 2019’s volume. In Germany, booking levels have declined to 50% of 2019 production. In November, Germans targeted local destinations but also the USA and Spain. Typical business destinations have understandably dominated warm and relaxing destinations. The destination that enjoyed significant growth in previous months was the USA, but its share was still nearly 12% lower than in 2019. Interestingly, the share of holiday destinations such as Spain, Turkey and Greece remained significantly higher than in the corresponding period in 2019.

In November, Germans targeted local destinations but also the USA and Spain. Typical business destinations have understandably dominated warm and relaxing destinations. The destination that enjoyed significant growth in previous months was the USA, but its share was still nearly 12% lower than in 2019. Interestingly, the share of holiday destinations such as Spain, Turkey and Greece remained significantly higher than in the corresponding period in 2019.

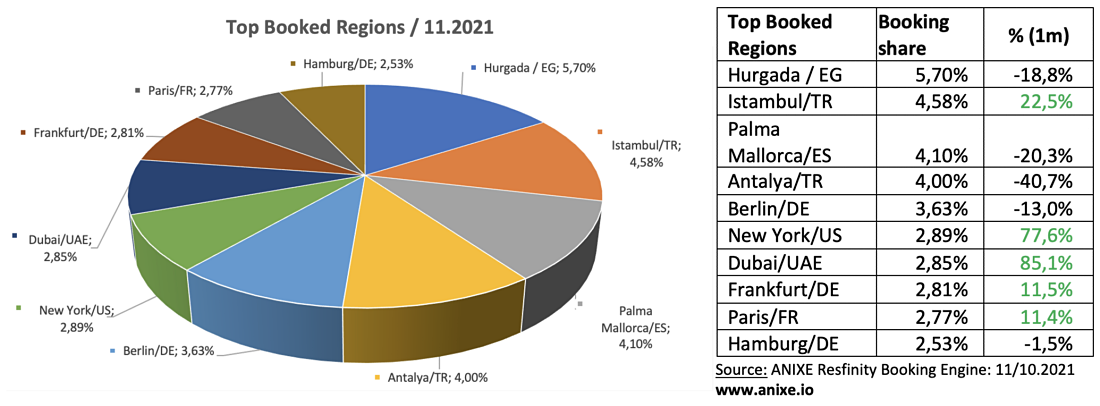

The first days of autumn have encouraged German travellers to make reservations for Egypt's Hurghada, Spain's Palma Mallorca and Turkey's Antalya & Istanbul, which in contrast to those mentioned above showed an increase in popularity of over 22%. New York and Dubai also grew strongly, although their share in the booking portfolio remained less spectacular.

However, the list lacked top-rated destinations in November 2019 - Las Vegas, London and Prague. Their share in 2021 - despite its still high position - fell by 24% for the first one and by an average of 50% for the other two destinations.

The first days of autumn have encouraged German travellers to make reservations for Egypt's Hurghada, Spain's Palma Mallorca and Turkey's Antalya & Istanbul, which in contrast to those mentioned above showed an increase in popularity of over 22%. New York and Dubai also grew strongly, although their share in the booking portfolio remained less spectacular.

However, the list lacked top-rated destinations in November 2019 - Las Vegas, London and Prague. Their share in 2021 - despite its still high position - fell by 24% for the first one and by an average of 50% for the other two destinations.

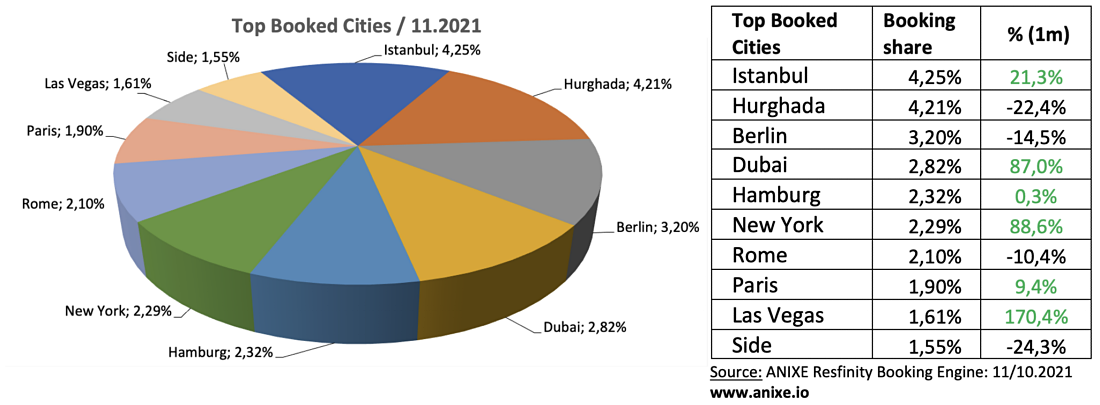

The four most popular destination cities in November 2021 for German travellers are Istambul, Hurghada, Berlin and Dubai. However, the latter, along with American New York and Las Vegas, in monthly terms, noted significant increases.

Compared to the situation two years ago, i.e.November 2019 - the most significant increase in holiday popularity was especially seen in Hurghada and Istambul. On the other hand, the most considerable decrease in share in the Resfinity Booking Engine was in London, Prague and… Frankfurt.

The four most popular destination cities in November 2021 for German travellers are Istambul, Hurghada, Berlin and Dubai. However, the latter, along with American New York and Las Vegas, in monthly terms, noted significant increases.

Compared to the situation two years ago, i.e.November 2019 - the most significant increase in holiday popularity was especially seen in Hurghada and Istambul. On the other hand, the most considerable decrease in share in the Resfinity Booking Engine was in London, Prague and… Frankfurt.

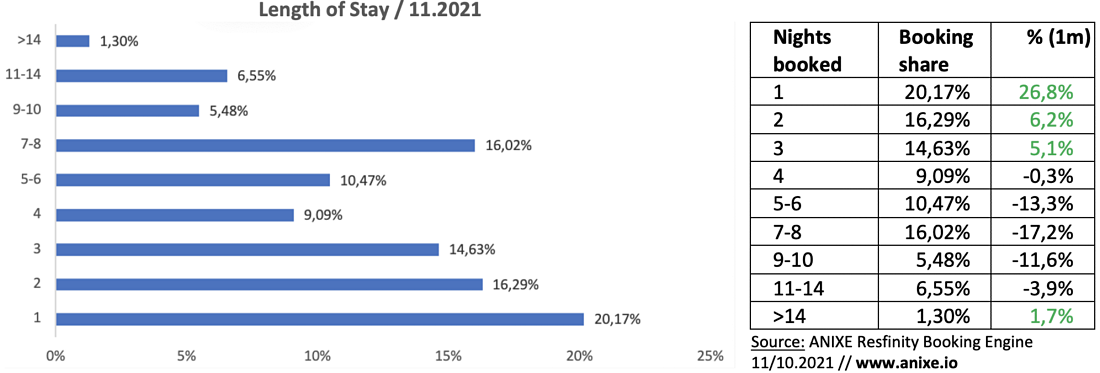

German travellers have enjoyed travels lasting about a week for the past six months. The end of summer vacations and people going back to work has increased the popularity of shorter trips - mainly one-day trips. Although a similar trend was also observed two years ago, the current figures show a rather inflated share of 5–8-day trips in favour of 1-day trips. In November 2019, their popularity was 20% higher than it is now.

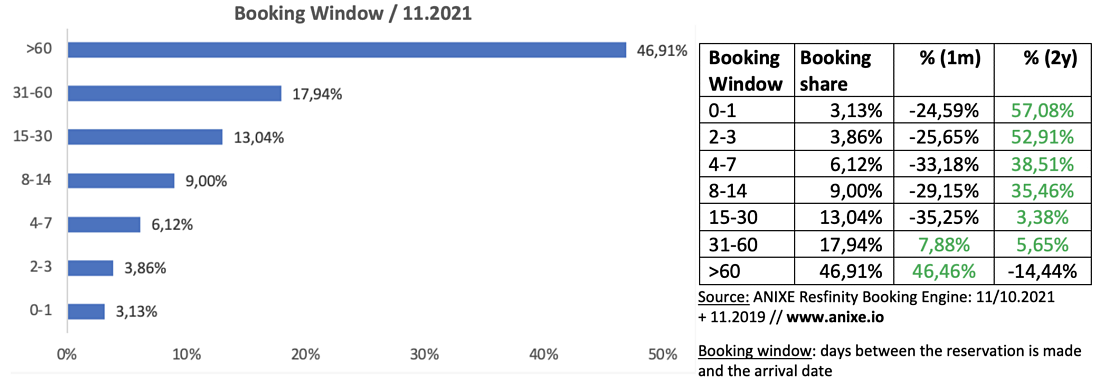

In November 2021 - just like two years ago - interest in early booking offers (over 60 days) is growing, making way for bookings made 3-4 weeks in advance. In the last period, this trend was confirmed, and people eagerly made their reservations disregarding the developing 4th wave of the pandemic and intensifying outbreaks.

German travellers have enjoyed travels lasting about a week for the past six months. The end of summer vacations and people going back to work has increased the popularity of shorter trips - mainly one-day trips. Although a similar trend was also observed two years ago, the current figures show a rather inflated share of 5–8-day trips in favour of 1-day trips. In November 2019, their popularity was 20% higher than it is now.

In November 2021 - just like two years ago - interest in early booking offers (over 60 days) is growing, making way for bookings made 3-4 weeks in advance. In the last period, this trend was confirmed, and people eagerly made their reservations disregarding the developing 4th wave of the pandemic and intensifying outbreaks.

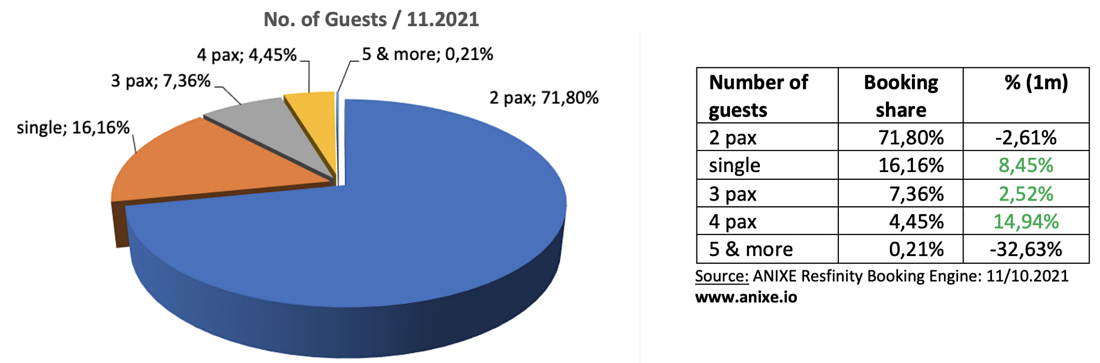

The same is true for trends by impacting group travel. Current indications are roughly in line with those from 2 years ago. Dominating are groups of 2 people and singles. Surprisingly, the share of single bookings in November 2021 was 8% higher in both October 2021 and November 2021.

The same is true for trends by impacting group travel. Current indications are roughly in line with those from 2 years ago. Dominating are groups of 2 people and singles. Surprisingly, the share of single bookings in November 2021 was 8% higher in both October 2021 and November 2021.

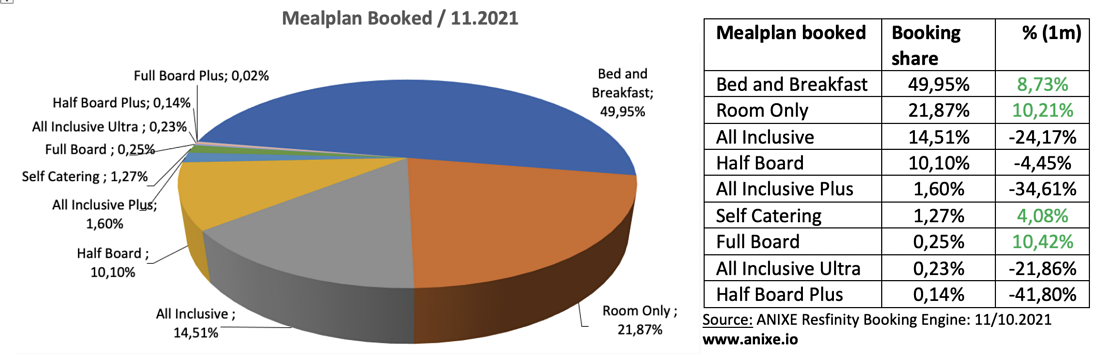

ANIXE's market data shows that the increase in business travel is matched by the rise in the popularity of rooms with breakfast only or even no meals. It also reflects the situation in the same period before the pandemic, where the popularity of rooms in the RO (Room Only) category booked by tour operators was even 10% higher.

ANIXE's market data shows that the increase in business travel is matched by the rise in the popularity of rooms with breakfast only or even no meals. It also reflects the situation in the same period before the pandemic, where the popularity of rooms in the RO (Room Only) category booked by tour operators was even 10% higher.

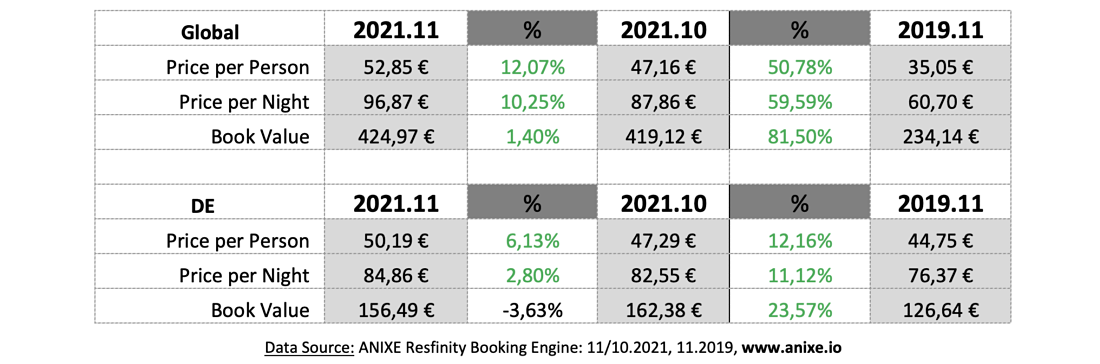

As far as prices are concerned, hotel prices start to increase after the peak of the holiday season - both on a monthly and biannual basis. So it shouldn't be surprising considering the increase in 1-2 person trips and decrease in multi-bed rooms in November's bookings. On the other hand, the high level of inflation, which is weighing on both European and global economies, can significantly impact price differences in a two-year perspective.

As far as prices are concerned, hotel prices start to increase after the peak of the holiday season - both on a monthly and biannual basis. So it shouldn't be surprising considering the increase in 1-2 person trips and decrease in multi-bed rooms in November's bookings. On the other hand, the high level of inflation, which is weighing on both European and global economies, can significantly impact price differences in a two-year perspective.

Although the positive trend we've become accustomed to since the beginning of the year is faltering, we must not stop searching for our next perfect getaway. Plan your summer. Book that villa in the Maldives! Take the kids to Disneyland! Take your significant other to that romantic getaway in wine country.

How soon will we start to see bookings rise again? What destinations will grow in popularity in the winter season? Will people go skiing? Stay tuned for the next ANIXE Insights.

Although the positive trend we've become accustomed to since the beginning of the year is faltering, we must not stop searching for our next perfect getaway. Plan your summer. Book that villa in the Maldives! Take the kids to Disneyland! Take your significant other to that romantic getaway in wine country.

How soon will we start to see bookings rise again? What destinations will grow in popularity in the winter season? Will people go skiing? Stay tuned for the next ANIXE Insights.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific