About us

We work with reliable data providers with global coverage, that guarantee data representativeness as well as compliance with International Personal Data Protection laws. Our data sources are as varied as the different modules we offer for tourism analysis. Tourist Behaviour: we analyse spontaneous interactions on Social Media and Opinion platforms related to the tourism sector in order to extract indicators based on visitors’ interests and perceptions. Accommodation offer for a specific destination (hotels and alternative accommodation): we work with data from OTAs (Online Travel Agencies) and tourism reservation platforms. Air Connectivity: we analyse patterns related to air schedules, flight searches, flight bookings via data from the main GDSs (Global Distribution System) and companies specialised in monitoring air connectivity. Spend at destination: we analyse patterns of ...Read more

Mabrian Technologies - About Us

We work with reliable data providers with global coverage, that guarantee data representativeness as well as compliance with International Personal Data Protection laws. Our data sources are as varied as the different modules we offer for tourism analysis.

- Tourist Behaviour: we analyse spontaneous interactions on Social Media and Opinion platforms related to the tourism sector in order to extract indicators based on visitors’ interests and perceptions.

- Accommodation offer for a specific destination (hotels and alternative accommodation): we work with data from OTAs (Online Travel Agencies) and tourism reservation platforms.

- Air Connectivity: we analyse patterns related to air schedules, flight searches, flight bookings via data from the main GDSs (Global Distribution System) and companies specialised in monitoring air connectivity.

- Spend at destination: we analyse patterns of Spend for visitors to a destination based on credit and debit card usage (or equivalent digital means). This data comes from the main providers of payment channels.

- Presence and mobility: we monitor presence and mobility of visitors through their mobile devices’ connectivity to antennas located in the destination. This data comes from mobile network companies that are present in the destination.

Company Name : Mabrian Technologies

News & announcements

-

15 Oct 24

NEWS

Mabrian data: Uneven air connectivity recovery in OceaniaTourism to the Oceania region continues to bounce back from the pandemic, but is being ...Read moreMabrian data: Uneven air connectivity recovery in Oceania - News & announcementsTourism to the Oceania region continues to bounce back from the pandemic, but is being stifled as air lift is not fully keeping up with demand. Mabrian, the global travel intelligence platform, reveals promising travel intention trends from markets like the US India, China, and Europe, signalling potential growth for 2024 and beyond. It says Oceania is facing an uneven recouping in air connectivity. Mabrian shared its analysis with the World Travel & Tourism Council at the recent Perth Global Summit. Oceania is formed by 14 countries (UN Statistics Board) grouped in four macro regions: Australia & New Zealand, Melanesia, Micronesia and Polynesia. According to UN Tourism latest year-round data (2023), Oceania is close to reaching 2019 records. How does 2024 and early 2025 looks like for Oceania, in terms of travel demand? Mabrian dug into two indicators: seats availability variation and scheduling to understand to what extent connectivity recovered after the pandemic, and Share of Searches Index for Oceania, based on flight searches for the first semester of 2024, to travel throughout 2024 and until late winter 2025.

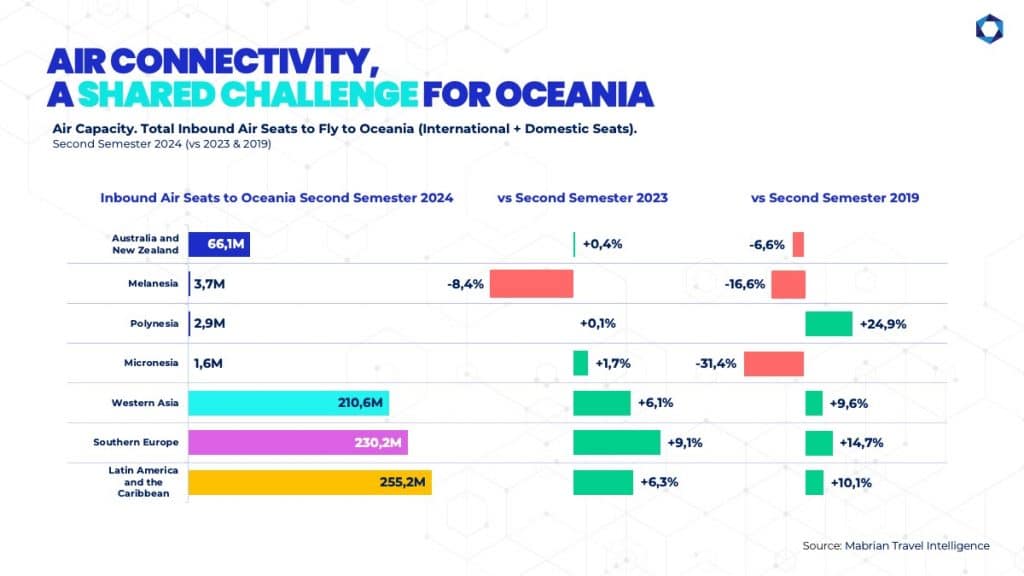

Air Connectivity, A Shared Challenge for Oceania

Due to its geography, Oceania is highly dependent on the air connectivity, domestic, regional, and international, so it is a crucial competitiveness factor for this continent.

According to Mabrian's travel intelligence, overall regional connectivity to and within Oceania's countries has not fully recovered after the pandemic.

When comparing scheduled inbound and domestic air seats for the second half of 2024 with 2019 same period, data shows that only Polynesia is 25% above 2019 figures.

"The path to recovery in terms of air capacity is slower when compared to other world regions, in particular some with a strong travel & tourism market, such as Southern Europe, Western Asia or Latin America", said Carlos Cendra, Partner and Director of Marketing and Communications at Mabrian.

Focusing on inbound air seats to scheduled Oceania's destinations for full year 2024 (compared to 2023 and 2019), Mabrian's travel intelligence shows that air capacity recovery is progressive, and indicates an uneven recoup of air connectivity in the area favouring four destinations: Tahiti (French Polynesia), Nadi (Fiji), as well as Perth and the Sunshine Coast (Australia).

Tahiti (French Polynesia) increased +29% air seats availability compared 2019 and +1% growth compared to 2023; whereas, since 2019, Nadi (Fiji) grew +24% inbound air seats, +10% when compared to 2023.

When compared to full 2019, scheduled air seats indicate that inbound air connectivity is bouncing back +5% to Auckland (New Zealand), and +4% to both Queenstown (Australia) and to Port Moresby (Papua New Guinea). In fact, the capital of Papua New Guinea features a strong growing trend, as air seats' availability increases +13% year over year.

Data illustrates the gap between travel intention and air connectivity.

This difference is particularly acute for Sydney and Melbourne (Australia), and also for Auckland (New Zealand), where global seats availability has not recovered yet to 2019 levels.

Inspirational demand to travel to Sydney during 2024 and until late winter 2025 from the United States, China or Europe tripled compared to the same period last year and increased 160% from India.

In the case of Melbourne, demand from India tripled, from Europe increased 121%, from China grew 158%, and almost 80% from the United States.

The appetite to visit New Zealand's capital is also evident in these for markets.

"Oceania's destinations must follow up on these demand trends as it offers clear hints on which are the opportunity markets to tap into to reinforce and rebuild air connectivity to the region.”

How does 2024 and early 2025 looks like for Oceania, in terms of travel demand? Mabrian dug into two indicators: seats availability variation and scheduling to understand to what extent connectivity recovered after the pandemic, and Share of Searches Index for Oceania, based on flight searches for the first semester of 2024, to travel throughout 2024 and until late winter 2025.

Air Connectivity, A Shared Challenge for Oceania

Due to its geography, Oceania is highly dependent on the air connectivity, domestic, regional, and international, so it is a crucial competitiveness factor for this continent.

According to Mabrian's travel intelligence, overall regional connectivity to and within Oceania's countries has not fully recovered after the pandemic.

When comparing scheduled inbound and domestic air seats for the second half of 2024 with 2019 same period, data shows that only Polynesia is 25% above 2019 figures.

"The path to recovery in terms of air capacity is slower when compared to other world regions, in particular some with a strong travel & tourism market, such as Southern Europe, Western Asia or Latin America", said Carlos Cendra, Partner and Director of Marketing and Communications at Mabrian.

Focusing on inbound air seats to scheduled Oceania's destinations for full year 2024 (compared to 2023 and 2019), Mabrian's travel intelligence shows that air capacity recovery is progressive, and indicates an uneven recoup of air connectivity in the area favouring four destinations: Tahiti (French Polynesia), Nadi (Fiji), as well as Perth and the Sunshine Coast (Australia).

Tahiti (French Polynesia) increased +29% air seats availability compared 2019 and +1% growth compared to 2023; whereas, since 2019, Nadi (Fiji) grew +24% inbound air seats, +10% when compared to 2023.

When compared to full 2019, scheduled air seats indicate that inbound air connectivity is bouncing back +5% to Auckland (New Zealand), and +4% to both Queenstown (Australia) and to Port Moresby (Papua New Guinea). In fact, the capital of Papua New Guinea features a strong growing trend, as air seats' availability increases +13% year over year.

Data illustrates the gap between travel intention and air connectivity.

This difference is particularly acute for Sydney and Melbourne (Australia), and also for Auckland (New Zealand), where global seats availability has not recovered yet to 2019 levels.

Inspirational demand to travel to Sydney during 2024 and until late winter 2025 from the United States, China or Europe tripled compared to the same period last year and increased 160% from India.

In the case of Melbourne, demand from India tripled, from Europe increased 121%, from China grew 158%, and almost 80% from the United States.

The appetite to visit New Zealand's capital is also evident in these for markets.

"Oceania's destinations must follow up on these demand trends as it offers clear hints on which are the opportunity markets to tap into to reinforce and rebuild air connectivity to the region.” Related News Stories:

-

28 Dec 23

Partner News

New motivations for travel in Europe: trending destinations in 2024Experiential travel as a motive for a holiday has increased by 8 percentage points ...Read moreNew motivations for travel in Europe: trending destinations in 2024 - News & announcements- Experiential travel as a motive for a holiday has increased by 8 percentage points globally since 2019, with motivations to visit Europe following a similar pattern.

- Northern European countries are better positioned to capitalize on these new demand trends.

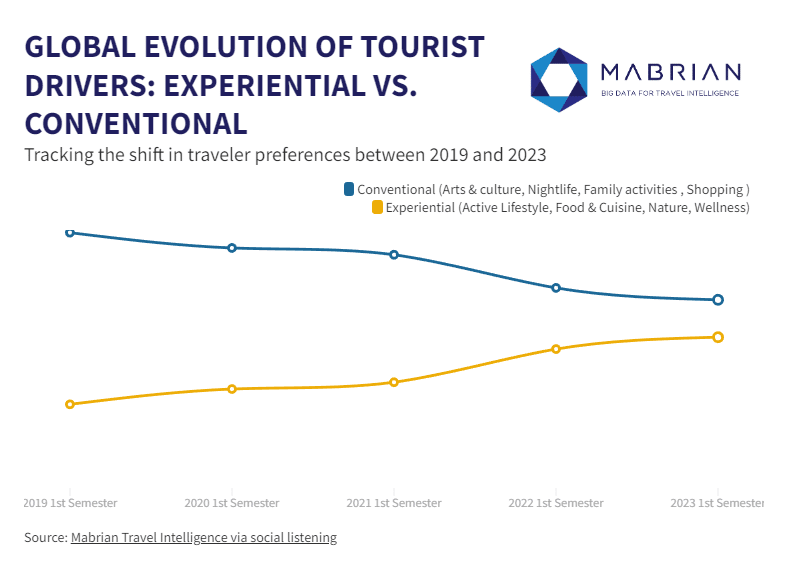

- Towards experiential travel: Mabrian's analysis indicates a global trend towards more experiential and less conventional travel motivations, with an 8% increase in experiential travel since 2019. Experiential tourism encompasses activities such as active, natural, gastronomic, and wellness experiences, while conventional tourism includes culture, sun and beach, family activities, nightlife, and shopping.

- New european trends reflecting global change: Europe has experienced an equivalent 8% growth in experiential activities from 2019 to 2023, reducing the prominence of conventional motivations. Active and nature tourism emerge as the fastest-growing, gaining 5 and 3 percentage points, respectively.

- Countries best positioned for experiential tourism: Countries in Northern Europe, including Iceland, Norway, Finland, Slovenia, and Switzerland, are better positioned to capitalize on the growing demand for experiential activities, with a share of over 60% in visitor interest.

- Potential trending destinations for 2024: Mabrian identifies Italy as the leading country with the most potential destinations (four), followed by France and Germany with two each. The top 10 trending regions for 2024 also include the United Kingdom and Portugal.

- Piedmont Region, Italy: Notable for destinations like Turin, Stresa, and Alba, Piedmont stands out with a balance of cultural and natural offerings. Gastronomic experiences feature prominently among experiential motivations, coupled with positive trends in flight accessibility.

- New Aquitaine, France: Featuring destinations such as Bordeaux, Biarritz, and Limoges, this region stands out for its oenological and gastronomic products alongside active tourism. The region enjoys good and stable air connectivity.

- East of England, United Kingdom: Including Cambridge, Essex, and Norfolk, this region achieves a balance between cultural and natural offerings, positioning it as a growing destination. Its solid and stable connectivity further supports its appeal.

- To complete the top 10 trending destinations, notable mentions include: Occitania (France), Campania (Italy), North Rhine-Westphalia (Germany), Lombardy (Italy), Emilia-Romagna (Italy), the province of Hamburg (Germany), and the province of Lisbon (Portugal).

-

16 Nov 23

Partner News

Croatia forecasts a 10% growth in tourism for this low season – Mabrian TechnologiesCompared to last year, Croatia anticipates higher tourism activity during the autumn and winter ...Read moreCroatia forecasts a 10% growth in tourism for this low season – Mabrian Technologies - News & announcements- Compared to last year, Croatia anticipates higher tourism activity during the autumn and winter months, with specific months showing an increase of more than 20%.

- A Seasonal Context with Room for Improvement. Croatia still has room for improvement during the considered low season months. When compared to the context and its closest competitors, the data indicates that the Southeast Mediterranean region is 9 percentage points more dependent on the high season than the average in the nearby Mediterranean, while Croatia is 16% more.

- Promising Prospects for the Low Season. One of the main takeaways from Mabrian's analysis is the promising outlook for Croatia in the coming months. It forecasts a 10% increase in tourism from September to March 24, compared to last year. In terms of growth, Croatia is expected to outperform Italy and Turkey during these months, although it has not yet reached the levels seen in Greece.

- Croatia Well Positioned for Travellers’ Motivations. According to the latest global travellers’ motivations study conducted by Mabrian, there is a consistent growth in experiential motivations for travel, substituting more conventional motivations. Analysis of travellers sentiment and preferences, based on over 400 million interactions on social media, reveals that interests in Active, Natural, Wellness, and Gastronomy experiences are gaining importance over Sunbathing, Family Travel, Shopping, and Nightlife. This positions Croatia with a great opportunity to solidify its leadership in Nature and Active tourism products during the low season, compared to Mediterranean competitors. Additionally, there is an interesting opportunity to further develop Gastronomy and Culture-related activities, which were among the main travellers interests from October to March during the Autumn-Winter 2022-2023 season.

-

13 Oct 23

Partner News

Hotel rate rises: how much is too much? Mabrian TechnologiesThis summer travellers booked hotels at never-before-seen prices. How can travel sellers and B2B ...Read moreHotel rate rises: how much is too much? Mabrian Technologies - News & announcements- This summer travellers booked hotels at never-before-seen prices. How can travel sellers and B2B distributors respond? What role does tech play?

- Data from travel intelligence provider shows 2023 August prices for hotels were up by 64.03% in North America when compared to 2019.

-

21 Aug 23

Partner News

Experiential travel replaces conventional motivations for travel – Mabrian TechnologiesMabrian analyzes the evolution of traveller behavior and their motivations for travel since 2019 ...Read moreExperiential travel replaces conventional motivations for travel – Mabrian Technologies - News & announcements- Mabrian analyzes the evolution of traveller behavior and their motivations for travel since 2019

- ‘Experiential’ definition includes activities such as Wellness, Active & Lifestyle, Nature & Food and Cuisine.

GRAPH: EXPERIENTIAL VS CONVENTIONAL

The activities that have picked up the most during these years reaching unprecedented levels of interest are Active & Lifestyle, Nature and Wellness. Regarding the two first ones, the data shows a clear inflection point from 2021, corroborating the effects of the pandemic in this type of motivations to travel. Wellbeing has also seen stable growth since 2019.

GRAPH: EXPERIENTIAL VS CONVENTIONAL

The activities that have picked up the most during these years reaching unprecedented levels of interest are Active & Lifestyle, Nature and Wellness. Regarding the two first ones, the data shows a clear inflection point from 2021, corroborating the effects of the pandemic in this type of motivations to travel. Wellbeing has also seen stable growth since 2019.

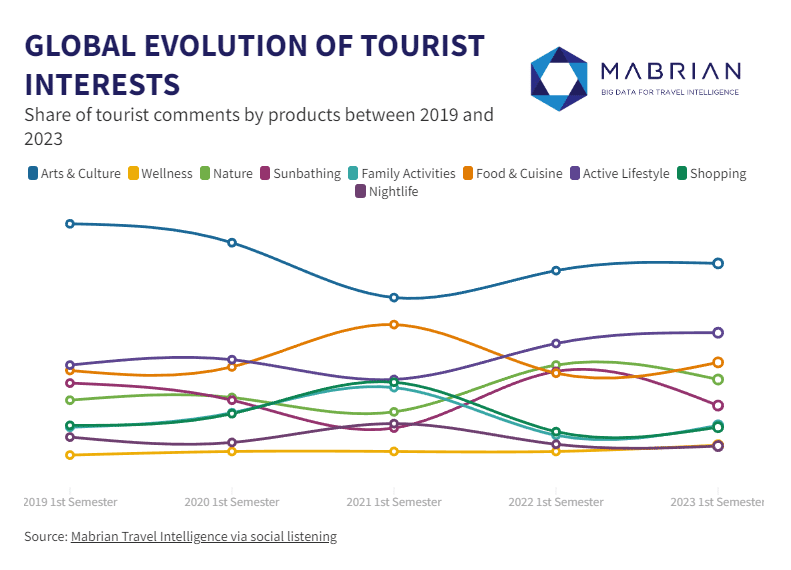

GRAPH: Global evolution of Tourist Interests: lines graph

On the other hand, conventional activities that have lost most of their importance are Arts & Culture and Sunbathing, which now represent only 34% of travel motivations, losing 7 percentual points since 2019.

GRAPH: Global evolution of Tourist Interests: lines graph

On the other hand, conventional activities that have lost most of their importance are Arts & Culture and Sunbathing, which now represent only 34% of travel motivations, losing 7 percentual points since 2019.

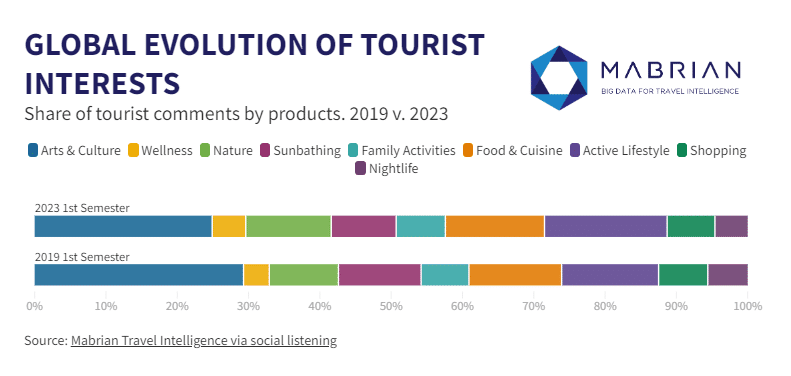

GRAPH: Global evolution of Tourist Interests: bars

Carlos Cendra, Chief Marketing and Communication Officer at Mabrian comments: “the way we travel is constantly switching. From the traditional holidays of sunbathing in coastal destinations and culture and shopping in the cities, to disconnecting and discovering experiences where the connection with the environment and ourselves is key. There’s an obvious impact of the pandemic and the effect of being locked down that made us realise how important it is to enjoy the outdoors and feel well and healthy during our free time which has stuck in travellers’ motivations”.

Mabrian highlights that it is essential for destinations and tourism companies to detect new global trends among travellers in an agile manner, while working to offer a tourism product that is as diversified as possible and in line with new trends. High dependence on specific tourism products causes inefficiencies related to high dependence on certain source markets and high seasonality patterns. These factors are of great importance when it comes to promoting the sustainability of the destination.

GRAPH: Global evolution of Tourist Interests: bars

Carlos Cendra, Chief Marketing and Communication Officer at Mabrian comments: “the way we travel is constantly switching. From the traditional holidays of sunbathing in coastal destinations and culture and shopping in the cities, to disconnecting and discovering experiences where the connection with the environment and ourselves is key. There’s an obvious impact of the pandemic and the effect of being locked down that made us realise how important it is to enjoy the outdoors and feel well and healthy during our free time which has stuck in travellers’ motivations”.

Mabrian highlights that it is essential for destinations and tourism companies to detect new global trends among travellers in an agile manner, while working to offer a tourism product that is as diversified as possible and in line with new trends. High dependence on specific tourism products causes inefficiencies related to high dependence on certain source markets and high seasonality patterns. These factors are of great importance when it comes to promoting the sustainability of the destination. -

20 Jan 23

Partner News

The fastest growing source markets with flights to Madrid for 2023Mexico and Colombia lead the destinations with the highest growth in air capacity to ...Read moreThe fastest growing source markets with flights to Madrid for 2023 - News & announcements- Mexico and Colombia lead the destinations with the highest growth in air capacity to travel to the Spanish capital in 2023

In addition to the data on growth in air capacity, the origin destinations that will visit Madrid the most, in order, will be: the Spainish domestic market to Madrid, followed by Italy, France, Portugal, the United Kingdom, the United States, Germany, Mexico, Colombia and Swizterland.

In this ranking there are changes compared to 2019, when the United Kingdom was in fourth place followed by Germany, and Mexico was in last place. Thus, in 2019, the destinations that visited Madrid the most were: Spain, Italy, France, the United Kingdom, Germany, the United States, Portugal, Switzerland, Colombia and Mexico.

In addition to the data on growth in air capacity, the origin destinations that will visit Madrid the most, in order, will be: the Spainish domestic market to Madrid, followed by Italy, France, Portugal, the United Kingdom, the United States, Germany, Mexico, Colombia and Swizterland.

In this ranking there are changes compared to 2019, when the United Kingdom was in fourth place followed by Germany, and Mexico was in last place. Thus, in 2019, the destinations that visited Madrid the most were: Spain, Italy, France, the United Kingdom, Germany, the United States, Portugal, Switzerland, Colombia and Mexico. -

30 Aug 22

Partner News

Could climate change mean that winter becomes the new summer in travel? – Mabrian TechnologiesWhen it comes to climate change the travel industry needs to change its approach ...Read moreCould climate change mean that winter becomes the new summer in travel? – Mabrian Technologies - News & announcementsWhen it comes to climate change the travel industry needs to change its approach to ‘summer holidays’ if it doesn’t want to get caught out in the cold ‘Winter is coming’ is the Stark family’s moto in Game of Thrones and in the travel industry this might be the case when it comes to ‘summer holidays’ due to climate change. This year saw heat records broken in most of the main European summer tourism destinations, in some cases by quite significant margins, and climate experts are predicting that many places popular with tourists soon will be scorching hot every summer. What does this mean for a tourism industry largely based around summer peak season visitors? Could winter become the new summer or will tourists start visiting new destinations where the climate is more bearable? We spoke with six experts to find out more. Carlos Cendra, Sales and Marketing Director at travel intelligence provider Mabrian says: “If anyone thinks that hotter weather is good news for beach traditional beach destinations then they should think again. During this summer’s heat wave in Europe we saw a clear drop in visitor satisfaction levels during the hottest weeks. The weather is one of the most important contextual factors for the tourism industry. Hundreds of vacational destinations in the Mediterranean and North Africa have traditionally based their tourism development on favorable weather conditions. Now this is changing, and faster than we thought. This is probably going to change global travel trends within the next years, so we’d better analyze the effects of this on the expectations and preferences of travellers.” Matthew Chapman, CTO of travel booking technology provider Vibe comments: “Online travel agents and other digital points of sale for travel should consider adding a filter that lets people search by average temperatures for the dates they are looking. Likewise hotels, experiences providers, perhaps even airlines and airports should all start considering populating their content with information about air conditioning, shaded areas, and so on – and make that content searchable and filterable in the booking process. More and more people will be concerned by such details at the search and booking stage.” Alex Barros, Chief Marketing and Innovation Officer from Beonprice, the revenue management & total profitabilty platform for for the hospitality sector, adds: “From a revenue management perspective for hoteliers this is a potentially enormous change as pricing for leisure travel has all been defined by the same summer peak season approach since the beginning of mass tourism in the 1960s. More research will be needed around how temperatures impact consumer demand. What is the ideal temperature for maximum pricing? Is it impacted by temporary volatility in temperatures, or just long-term averages? All of this will of course impact how hoteliers approach building and opening new properties too, not just location but temperature-controlled buildings and communal areas.” Fabián Gonzalez, Co-Founder of Forward_MAD, a luxury tourism event taking place in Madrid from 5th to 7th October, says: “Luxury hotels and resorts, and luxury experiences generally, are better positioned to adapt to the challenges of climate change as they have the resources to invest in what is needed – better climate controlled buildings, air conditioned transfers, and so on – and have more demanding clients in terms of sustainability expectations, who are prepared to pay for this. Contrast that with mass-market tourism providers with low-margins where such costs would be the difference between profit and loss. Additionally a shift towards tourists spreading their holidays out throughout the whole year, adapting to ‘wintering’ rather than ‘summering’, could suit many boutique and smaller luxury hotels with only a limited number of rooms – allowing them to fill them up in the normally quieter months. Not least as high spending travellers normally are more flexible in terms of vacation dates anyway.” Bruno Martins, Senior Product Manager from the global hospitality technology provider Shiji Group comments: “Hotels and resorts in hotter locations will have to re-think their outdoor relaxation areas, perhaps putting an end to ‘outside’ pools or at the very least placing some kind of cover over the top – and making them more nighttime friendly too, including lifeguard services, or perhaps even charging for peak hours. Equally the spa centres should be rethought, positioning them more as a place to go and cool down – with less saunas and more ice baths. Golf courses are a popular draw for hot locations and they too will be impacted, quite heavily in fact as you can’t cover a whole golf course with screens and more watering will be required at a time when water becomes more scarce. Again nighttime, or at least early morning, tee-offs will be in greater demand. Technology is going to be the golden-thread throughout all of these changes, whether that be via apps that allow guests to schedule better those precious cool moments, pricing software that maximizes revenues based on temperature, or electronic wrist bands that allow guests access (or not!) to certain locations at certain times based on demand. Basically hotels can already start optimizing revenue for the activities based on time of day, where demand will increase and improve revenue management of rates.” Janis Dzenis, Director of PR for the recently launched flight price comparison website WayAway also says: “For many US travellers going to Europe, summer is still all about the Mediterranean region and that might take a long while to change no matter how hot it becomes. Especially keeping in mind that for many US visitors to Europe this is a one-off, special trip – they aren’t basing their choice on previous experiences, but on what they saw in a movie or a friend told them. Any reality will take time to filter through. However in the short term all this recent hot weather around the world is driving eco-consciousness amongst travellers. So they´ll want to know what destinations and hotels are doing to fight this and those that don’t have a convincing answer will gradually lose out. This will also drive more demand for travellers to offset their carbon footprint too and this is a service we offer to our WayAway Plus subscribers, one that is proving very popular.” -

07 Jul 22

Partner News

Mabrian reinforces its team to accelerate its expansion in Europe, the Middle East and Latin AmericaIncorporation of four people to enhance the company’s presence in different regions to offer ...Read moreMabrian reinforces its team to accelerate its expansion in Europe, the Middle East and Latin America - News & announcements- Incorporation of four people to enhance the company’s presence in different regions to offer solutions based on tourism intelligence.

- The team has grown by 20% since 2021, now forming a total of 27 people.

- Mabrian now has a multicultural team with 11 nationalities speaking 10 languages.

- Chris Ramaciotti is the new Business Development Manager for Northern Europe. He has an international MBA and extensive experience in the luxury hotel sector. For Chris, “the technology developed by Mabrian is a central element when it comes to meeting the needs of a traveler since we accompany destinations and companies so that they can better understand their behavior and adapt their strategies”.

- While Parisa Bakhtiari is the new Business Development Manager for the Asia, the Middle East and Africa areas. A telecommunications engineer with a background in tourism, she has spent many years of her career focused on the travel industry. “I am passionate about exploring data in tourism, and with this passion I am dedicated to facilitating the incorporation of tourism intelligence in tourism policies and strategies, whilst helping the sector to take advantage of the opportunities of big data.”

- Mary Menchón is Mabrian’s Business Development Manager for Spain, Portugal and LATAM. Trained in tourism andcommunication, her work experience has focused on the tourism sector from different perspectives. “At Mabrian, a company that I have known since 2018, I know how to provide the vision of working and implementing the use of big data for DMO’s from scratch, since I myself experienced that process. For me, being able to help tourist destinations implement this tool and being able to continue contributing my part for the recovery of tourism is my greatest motivation”.

- And Catalina Taltavull is Mabrian’s new global public procurement coordinator. She has a mixed profile between aeronautical engineering, business development and extensive experience in the tourism and accommodation sector. Her functions at Mabrian are summed up in her own words: “We are facing the birth of a new service sector for tourism managers: Tourism Intelligence. The highly unstable context that the sector is facing makes administrations increasingly see the need to professionalize and have information to make better decisions. At Mabrian what we have is a solution developed and approved with more than five years of experience in the market, ready to provide an agile solution to the sector.”

-

27 Jun 22

Partner News

Research from Mabrian on average hotel prices for Mediterranean destinationsMabrian has conducted a study of average hotel prices by room type for all ...Read moreResearch from Mabrian on average hotel prices for Mediterranean destinations - News & announcementsMabrian has conducted a study of average hotel prices by room type for all the main Mediterranean destinations: overall prices are up on 2019, but not everywhere – and Greece is the big surprise, with increases up to 110% in five star rooms. Carlos Cendra, Sales & Marketing Director at Mabrian comments: “With few exceptions all the main Mediterranean destinations are seeing modest increases on average prices from 2019 across three, four and five star hotels. “France is the main exception, with a 12% and 11.3% drop in prices for three and four star hotels respectively – but it’s worth pointing out that it is not all bad news, as its five star hotels are still the most expensive in the region at €419 per night (and up by 13.2% compared to 2019). “Meanwhile Egypt’s prices are up strongly across all three categories, at 25%, 40.9% and 48.3%. But Greece is the real star here, with four and five star hotels seeing a 62.7% and a 110% increase respectively.” -

10 May 22

Partner News

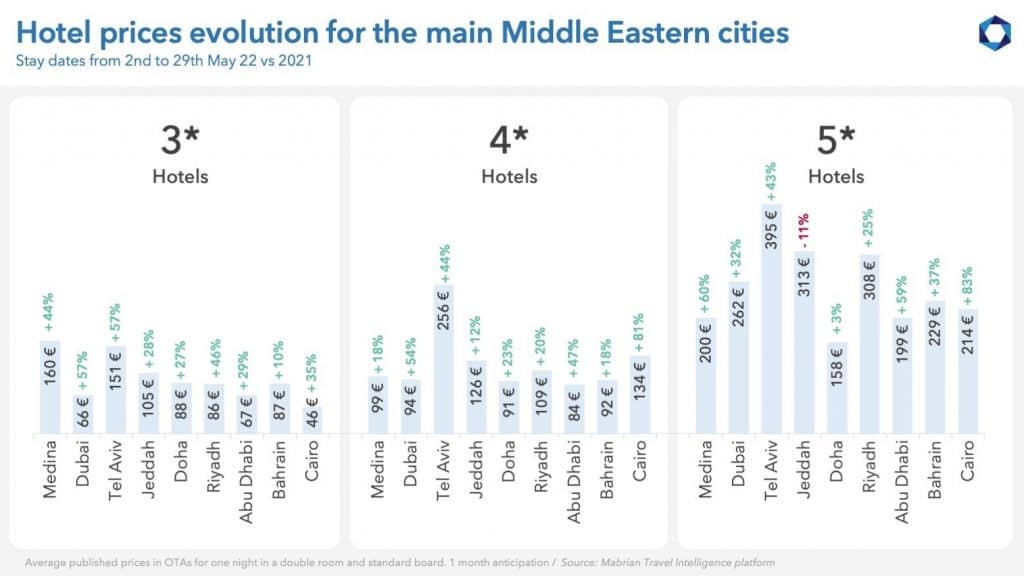

Middle Eastern destinations still on the way to recovery – Mabrian TechnologiesData shows that the region is still on the way to recovering pre-pandemic values ...Read moreMiddle Eastern destinations still on the way to recovery – Mabrian Technologies - News & announcements- Data shows that the region is still on the way to recovering pre-pandemic values but also shows significant changes in terms of origin markets capacity and hotel prices

Right now Dubai, Doha, Jeddah and Riyadh are the best connected cities in the Middle East, adding between the four more than 38 million incoming places for the next three months – or 70% of all places scheduled for the nine cities analyzed (54.4 million places).

For its part, the main European markets of origin for destinations in the Middle East are the United Kingdom, Germany, France and Italy. Among the European markets, only Austria shows better connectivity with the Middle East than in 2019 and both the United Kingdom and Germany are still 20% below 2019 figures.

Regarding accommodation, the analysis of the average prices of 1,141 hotels of all categories in these cities for the next month shows a relevant price increase. Prices have risenon average more than 20%, reaching increases of 80% in some specific cases. The cities with the most expensive accommodation are Medina, Dubai and Tel Aviv, where the average prices per night are between €136 and €168.

Right now Dubai, Doha, Jeddah and Riyadh are the best connected cities in the Middle East, adding between the four more than 38 million incoming places for the next three months – or 70% of all places scheduled for the nine cities analyzed (54.4 million places).

For its part, the main European markets of origin for destinations in the Middle East are the United Kingdom, Germany, France and Italy. Among the European markets, only Austria shows better connectivity with the Middle East than in 2019 and both the United Kingdom and Germany are still 20% below 2019 figures.

Regarding accommodation, the analysis of the average prices of 1,141 hotels of all categories in these cities for the next month shows a relevant price increase. Prices have risenon average more than 20%, reaching increases of 80% in some specific cases. The cities with the most expensive accommodation are Medina, Dubai and Tel Aviv, where the average prices per night are between €136 and €168.

Carlos Cendra, Sales & Marketing Director of Mabrian, comments "despite the fact that this study reveals that in the Middle East the rate of recovery is not the same as in other regions, the short-term prospects are good if the current dynamic continues – as we are seeing and commenting during this Arabian Travel Market. It must be taken into account that some of the important markets for this region, such as China, have not yet recovered their pre-pandemic demand.”

Carlos Cendra, Sales & Marketing Director of Mabrian, comments "despite the fact that this study reveals that in the Middle East the rate of recovery is not the same as in other regions, the short-term prospects are good if the current dynamic continues – as we are seeing and commenting during this Arabian Travel Market. It must be taken into account that some of the important markets for this region, such as China, have not yet recovered their pre-pandemic demand.” -

07 Apr 22

Partner News

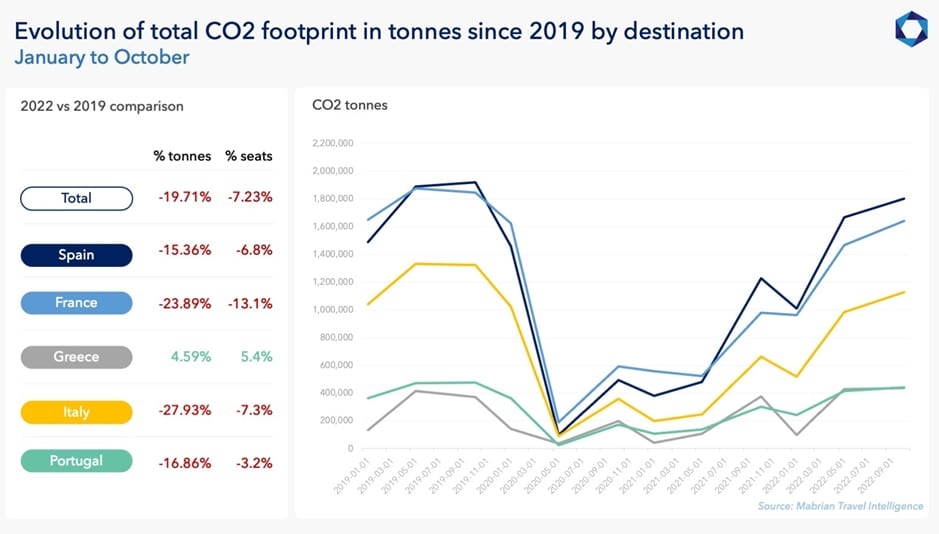

Mediterranean destinations improve efficiency in CO2 emissions compared to 2019 – Mabrian TechnologiesMabrian, in a new study based on tourism data and intelligence, compares the aviation ...Read moreMediterranean destinations improve efficiency in CO2 emissions compared to 2019 – Mabrian Technologies - News & announcements- Mabrian, in a new study based on tourism data and intelligence, compares the aviation carbon footprint of the main Mediterranean destinations for 2019 with 2022

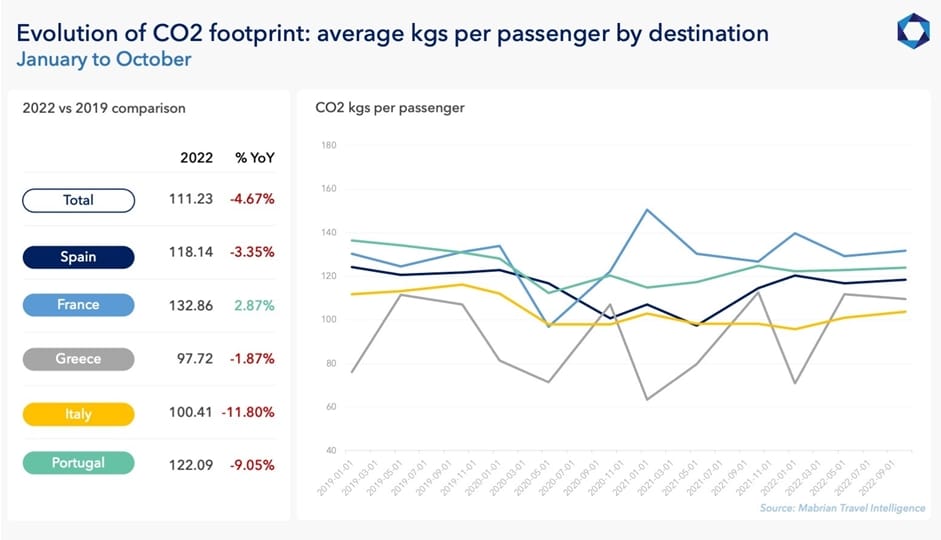

- CO2 emissions have been calculated – in total and per passenger – for incoming air connectivity into all airports in Portugal, Spain, France, Italy and Greece, including all origins

- The company presents its new carbon footprint indicator, which is added to its platform of tourism sustainability indices for destinations

- In total, the destinations studied will emit between January and October this year 46.5 million tonnes of CO2 into the atmosphere due to air connectivity. This represents a reduction of 19% compared to the same period in 2019.

- However, the reduction in incoming air seats for these destinations between January and October is only 7.23% compared to 2019 – which shows an improvement in CO2 efficiency.

- Meanwhile the average carbon footprint per passenger is reduced by 5% compared to 2019, going from an average of 120 kg/passenger to 114 kg/passenger.

- The reduction in intercontinental travel and the renewal of fleets with more fuel efficient models by airlines are favoring this positive evolution.

- Spain is the destination that emits the most carbon footprint as it is the country that will receive the most visitors. However, its average carbon footprint per visitor is lower than that of France or Portugal.

- Greece is the country that shows the best efficiency in average CO2 per passenger received during 2022 with 97.72 kg/passenger, 14% below the average of the rest of the destinations. This is despite being the only destination that will increase its total emissions during 2022, since it also expects to receive more visitors: the total tonnes of CO2 emitted will increase by 4.6%.

- Italy and Portugal are the destinations that most manage to reduce their carbon footprint per passenger, reducing 1.8% and 9% respectively.

- France is the only one of the five countries analyzed that will increase emissions per passenger during 2022 compared to 2019, by 2.9%. However, it has the second highest reduction in total emissions, by 24%. This is only behind Italy, which reduces emissions by 28% compared to 2019.

-

18 Mar 22

Partner News

Instability in Eastern Europe fuels Easter Week in Spain and Portugal – Mabrian TechnologiesMabrian study detects that the impact of the war has affected trends in supply and ...Read moreInstability in Eastern Europe fuels Easter Week in Spain and Portugal – Mabrian Technologies - News & announcements- Mabrian study detects that the impact of the war has affected trends in supply and demand for accommodation during Easter

- The data focuses on the evolution of flight search demand from the United Kingdom, one of the main European source markets, to Spain, Portugal, Turkey and Greece – plus the evolution of average hotel prices

- Portugal is the destination that seems to benefit the most from a shift in demand from the United Kingdom

- Following the outbreak, flight searches and spontaneous demand from the United Kingdom grew by 13.2% for Portugal and 12.7% for Spain, while it fell -10.45% for Turkey and -8.15% for Greece.

- Searches for flights from the UK to these four destinations fell sharply overall in the days after the war broke out by between 30% and 40%. However, search volumes for Spain and Portugal recovered within 5-6 days, while Turkey and Greece had not recovered volumes 13 days later.

- The average prices of accommodation in Spain and Portugal grew for Easter in all categories.

- Portugal is the country where prices rise the most with +15% in 3-star hotels, +6% in 4-star hotels and +17% in 5-star hotels. Spain follows with +14%, +4% and +9% respectively.

- In Turkey, the average prices of 3- and 4-star hotels fell, -4% and -3% respectively. These categories are those most frequented by Russian clientele. However, 5-star hotels are up 27%.

- In Greece, the average price of 3-star hotels fell by 9%, while 4- and 5-star hotels rose by 8% and 20%, respectively.

- In general, in Spain average hotel prices are more than 20% above the average of the destinations analyzed and 15% above the average prices of Portugal, its immediate competitor in terms of prices.

- Portugal is the destination that seems to feel the most the effect of a shift in tourist demand from the United Kingdom to Western European destinations, since it is the one that has grown the most in hotel searches and prices.

VIDEOS

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific