Expanded partnership means Amadeus will support innovative payment offerings across the travel industry through its B2B Wallet using Mastercard Wholesale Program

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

-

20 Sep 23

Partner News

Changing times: How spending trends are reshaping citiesMajor changes to the ways people eat out and socialize post-pandemic are resetting the “economic ...Read moreChanging times: How spending trends are reshaping cities - News & announcementsMajor changes to the ways people eat out and socialize post-pandemic are resetting the “economic clock” of cities from New York to Melbourne and Sydney to London. Increased hybrid working means New Yorkers are choosing restaurants closer to home, and that’s driving a jump in spending in areas such as the Bronx and Queens. In central Sydney, Thursday now tops Friday as the night to go out while Melbourne’s suburban restaurants are seeing a lunchtime boom. Restaurants in London’s business areas are still feeling the impact of fewer office workers, but tourists are providing a boost and the West End retains its crown as the most popular place for a night out. Tapping into these data-driven insights from the Mastercard Economic Institute can help restaurants cash-in on emerging trends and cities begin to adapt transport and infrastructure to suit changing times. LONDON In the City and Canary Wharf, restaurant spending is down, but the good news? Happy hour is up. Explore

SYDNEY AND MELBOURNE

In the City and Canary Wharf, restaurant spending is down, but the good news? Happy hour is up. Explore

SYDNEY AND MELBOURNE

Sydney’s increase in bar and restaurant spending has been more substantial than in Melbourne, particularly at night. Explore

Sydney’s increase in bar and restaurant spending has been more substantial than in Melbourne, particularly at night. Explore

NEW YORK CITY

The lunch scene in the outer boroughs is booming and nighttime spending is up in the Financial District. Explore

-

20 Sep 23

Partner News

Digital assets need to be safer. Here are some ways to do thatBlockchain-based ecosystems have unleashed incredible innovative potential and are creating exciting opportunities to tackle some ...Read moreDigital assets need to be safer. Here are some ways to do that - News & announcementsBlockchain-based ecosystems have unleashed incredible innovative potential and are creating exciting opportunities to tackle some of the stickiest challenges in today’s financial ecosystem. Yet it’s not clear how all this potential can be harnessed as safe and scalable business models. Innovators, traditional financial firms, policymakers, regulators and global standard-setting bodies are all trying to solve that puzzle in ways that preserve the integrity of the global financial system. The development and adoption of digital assets are still in early stages, and more work is needed by many participants to improve security and compliance. One effort toward this broader goal is Mastercard’s new Multi-Token Network, which will explore a set of rules and services designed to make blockchain ecosystems safer and more predictable. We believe the Multi-Token Network can encourage positive developments in the private sector, enabling the broader adoption of blockchain technology as an engine for digital commerce and innovation across the financial system. For example, blockchain technology could be utilized to build more efficient and faster cross-border payment rails that are always on, unlike traditional financial infrastructure, which often imposes delays related to business hours and holiday closures. Clear regulatory guidance, alongside private sector innovations like the Mastercard Multi-Token Network, could both unlock greater innovation and support stronger compliance. Understandably, regulators and policymakers are concerned about the many risks in digital asset ecosystems, including the presence of fraud, market manipulation, money laundering, sanctions evasion and — increasingly — the potential to expose the traditional financial system to contagion. Regulators are faced with the challenge of developing rules that rein in these risks while supporting the innovative potential of digital assets. The variety of blockchain services, nuances in each blockchain technology and the complex networks of intermediaries that enable them mean that established regulatory frameworks may fall short; bespoke rules that borrow from oversight practices in disparate industries are needed. Regulators and the private sector are working toward the same goal: safe and secure adoption of innovative solutions that address real pain points in financial services. Public authorities have engaged in robust dialogue among themselves and with private actors. Tremendous progress has already been made by standard-setting international bodies such as the Financial Stability Board and by policymakers in the European Union, to name just a few, in clarifying obligations for new entrants and conceptualizing frameworks that will govern digital asset activities. Yet work remains to be done to overcome the barriers to the safe and compliant adoption of digital assets. New and prospective private sector standards and guardrails, including Mastercard’s Multi-Token Network, will have their best chance of succeeding if they develop alongside a handful of clearer regulatory frameworks. Those include:01 Clarification and enforcement of consistent compliance expectations across payment technologies

In general, all payment technologies and networks should operate under the same expected compliance requirements and enforcement actions, but that’s not the case today. More consistent compliance measures would help avoid regulatory arbitrage and ensure that incumbents and digital asset innovators are competing on a level playing field, as has been called for by the Financial Action Task Force.02 Establishment of clear regulatory frameworks for stable payment tokens

This would enable trust in the underlying store of value and address uncertainties around the regulatory treatment of floating digital assets. The development of robust regulatory frameworks for payment instruments within digital asset ecosystems, including stablecoins, tokenized deposits and, in some instances, central bank digital currencies should be a priority. The distinct characteristics of each of these assets necessitate that they be considered independently of one another.03 Upholding the integrity and stability of the system

Upholding the integrity and stability of the system. Today, technical vulnerabilities that make interactions with blockchain systems vulnerable to cyberattacks and heists, as described in this MIT research paper, arguably pose one of the greatest risks to the whole ecosystem. The concentration of activity on just a handful of blockchains and the role of third-party services that support decentralized finance represent additional ecosystem risks. Technical experts who are most familiar with these networks could facilitate industry cooperation and partnership with public authorities to develop appropriate obligations designed to uphold the integrity and stability of these ecosystems. Important work to understand the technical vulnerabilities of blockchains is already underway at the Financial Stability Board and the Banque de France.04 Redoubling efforts to attain global standards — and their broad adoption and implementation — to reduce the prevalence of regulatory arbitrage

In today’s “borderless” world, the most effective domestic regulations can be undermined in the absence of robust global regulatory cooperation, distorting the playing field for all. Substantial precedent already exists for global cooperation in complex areas of regulation and standard setting. We encourage authorities to maintain the momentum of international work by aligning on global standards and enforcing corresponding national-level requirements for ecosystem participants. The intersection of digital assets with the traditional financial system means that establishing oversight that can facilitate system integrity is paramount. Private and public actors have put forward proposals for supporting the safe and secure growth of blockchain-based platforms and services. These ideas range from establishing self-regulating organizations to a heavier hand from public authorities. At this early stage of development, it is difficult to identify which oversight methodology is most appropriate suited. However, we are encouraged by the global efforts of public and private actors to learn and partner, with a goal of bringing about better outcomes in financial services. RAISA SHEYNBERG, VICE PRESIDENT, REGULATORY ADVOCACY

RAISA SHEYNBERG, VICE PRESIDENT, REGULATORY ADVOCACY -

27 Oct 22

NEWS

Mastercard is evolving its products and solutions to better meet travel buyer and supplier needsTravelMole caught up with Rohnny Swennen, Vice President, Travel Industries, to hear about how Mastercard ...Read moreMastercard is evolving its products and solutions to better meet travel buyer and supplier needs - News & announcementsTravelMole caught up with Rohnny Swennen, Vice President, Travel Industries, to hear about how Mastercard is evolving its products and solutions to better meet travel buyer and supplier needs. Rohnny shed light on how the Mastercard Wholesale Program has been enhanced and what this means for the sector. What is the Mastercard Wholesale Program and how did that innovation come about? The Mastercard Wholesale Program is a business-to-business (B2B) payment solution that allows travel intermediaries to pay their partners and suppliers with greater flexibility, visibility, and protection. It was designed specifically for the travel sector, based on what we heard from our partners and customers about their B2B payment challenges. From the outset we wanted this product to reflect industry needs so we considered what makes travel transactions unique. Travel by nature is international, therefore so are the B2B payment flows that take place between travel buyers and suppliers as they bring consumer bookings to life. For this reason, pricing structure based on geography just doesn’t make sense. In addition, the manual processes that have historically supported these B2B payment flows weren’t keeping up with dynamic market needs. A lack of payment transparency and predictability was impacting liquidity. What challenges were you looking to address with the solution? Alternative payment methods typically have a lot of inefficiencies when it comes to facilitating global payment flows and unfortunately, they are still rife across B2B travel payment flows. These inefficiencies have left travel buyers and suppliers struggling with poor reconciliation, long settlement periods and a lack of payment protection for far too long. Payment networks like Mastercard have the structure in place to handle global transactions more efficiently and securely. By leveraging our proven virtual card technology and embedding it into a B2B solution specifically designed for B2B travel transactions, we knew we could bring a solution to market that would benefit the entire travel value chain. Back in 2015 when we first launched, we wanted the solution to increase B2B payment visibility and protection for the sector – little did we know just how essential these would become just a few years later. We’ve now enhanced the solution even further to meet the needs that the industry faces now, delivering enhanced flexibility through a more tailored product structure and removing the limitations of a pre-defined set of tiers. How has the Mastercard Wholesale Program evolved? The solution has always evolved based on industry feedback, back in 2019 we made lower product tiers available based on the needs of our partners. A lot has happened in the sector since then which is why we’ve again enhanced the solution based on industry feedback. Flexibility is more important than ever, but we also heard that a more tailored approach to products was important to support specific market, volume and product types. So, we took action and have evolved the program to provide a more tailored structure. Through the new enhancements, travel issuers will no longer need to set up dedicated BINs and account ranges to offer the different products to their customers. Going forward they will be able to easily convert the virtual card to a desired code or tier in real time through a simple API. Relationships between travel intermediaries and banking partners are evolving, and now the Mastercard Wholesale Program is encouraging even closer collaboration to ensure that B2B payment solutions support all potential future growth. What benefits does the evolved product bring to the travel industry? The last few years have shown that the future health of the travel ecosystem relies on closer collaboration, which is why we have evolved the solution with the entire travel value chain in mind. Benefits for travel agencies, suppliers and issuers include:- Flexibility;Issuers onboard once and Mastercard will develop a dynamic structure to support customer volumes.

- Control; Tailored tiers for different markets, currencies, and type of provider.

- Protection; Everyone across the travel value chain receives the standard card guarantee.

- Acceptance; Available to all travel issuers.

- Growth;Closer collaboration between supplier, buyer, and banking partner relationships realize mutually beneficial growth.

-

20 Apr 22

NEWS

Test tweetTest tweetLearn more about : Mastercard Vibe Tenerife Tourism ...Read moreTest tweet - News & announcementsTest tweetLearn more about : Mastercard Vibe Tenerife Tourism

Check Our partner Zone : Mastercard Vibe Tenerife Tourism

-

14 Apr 22

Partner News

Actuary Teams up with Mastercard to Help Travel & Tourism Industry Better Assess and Manage RiskT&E Risk Monitor solution enables acquirers to more accurately assess financial exposure when dealing ...Read moreActuary Teams up with Mastercard to Help Travel & Tourism Industry Better Assess and Manage Risk - News & announcementsT&E Risk Monitor solution enables acquirers to more accurately assess financial exposure when dealing with travel merchants.

Actuary, part of Perseuss Group,today announceda collaboration with Mastercard set to better support acquiring entities across the travel sector with adata-led risk assessment tool. Aftera successful pilot, the T&E Risk Monitoris being scaled by Actuary in partnership with Mastercardto providea real-time view of booking status across travel portfolios, increasing acquirer confidence when releasing funds to delayed delivery merchants (DDM). DDM transactions involve a time delay between when a consumer pays for a reservation and when they board a planeor stay at a hotel. To address the financial exposure acquiring entities experience due to this delay, Actuary is leveraging its travel insights platform and Mastercard’s global travel industry partnerships and experienceto launch the T&E Risk Monitor. The solution increases visibility across travel booking and B2B payment flowsthrough interactive dashboards from which customerscan run reports and create alerts. Providing a trusted source of secure booking and payment related data, the interactive platform enables acquirers to make data-led risk decisions, providing greater peace of mind when releasing funds and taking on new travel portfolios. Benefitting the whole ecosystem, travel merchants benefit from automation and transparency over reporting and risk levels, whilst the enhanced visibility supports greater cashflow and liquidity across the travel sector. Maarten Alleman, CEO of Perseuss Group, said: "Already pre-pandemic, the card acquirers'credit risk conditions were in many cases a major challenge for airlines and other travel merchants. This has been exacerbated by the unprecedented levels of booking cancelations and changes, large scale use of vouchers and operational issues around refunding. Together with Mastercard, we aim to leverage our combined capabilities to restore the much-needed balance between demand and supply in airline and travel acquiring services.” Commenting on the collaboration Chris Fendley, Executive Vice President–Enterprise Partnerships at Mastercard, said “Mastercard is scaling innovation to help the travel and tourism industry recover and grow, and our relationship with Actuary furthers our commitment to help organizations mitigate financial risk during times of heightened volatility. Through the T&E Risk Monitor, we are bringing the travel payment ecosystem together to increase visibility and assurance, helping acquirers make data-led decisions, and enhancing cashflow for travel merchants. -

07 Apr 22

Partner News

Faster arrivals and departures for your B2B payments – MastercardEvolving virtual card payment solutions for the global travel industry As digitization accelerates ...Read moreFaster arrivals and departures for your B2B payments – Mastercard - News & announcementsEvolving virtual card payment solutions for the global travel industry

As digitization accelerates the world over, and as travel behaviors shift, the travel industry is increasingly seeing the need for innovative and collaborative payment solutions. Using virtual card technology and an innovative pricing model, the Mastercard Wholesale Travel Program is designed to bring scalable and seamless cross-border B2B payments to the entire industry – ultimately creating a more secure, frictionless experience for you and your customers and accelerating future growth opportunities. Over 360,000+ travel providers across 200+ countries worldwide already rely on us to increase reconciliation efficiency, enable payment flow visibility, preserve liquidity, provide payments protection and enable payment guarantees. Start with partners and Start Something Priceless™. Download case studies.

Why use the Mastercard Wholesale Travel Program?

Through virtual card technology, fixed interchange rates and transparent issuing and acquiring core fees, the Mastercard Wholesale Travel Program reduces costs, enables operational efficiencies and decreases risk for travel agencies and travel suppliers alike.

Maximize sales

The multiple rate tiers and fixed interchange rates provide the travel industry with a flexible framework to address the unique economic needs of the industry facilitating commercial negotiations between travel agents and travel suppliers.

For travel agencies, enabling closer relationships with suppliers to increase the range of products and generate additional sales

For travel suppliers, an ability to define payments terms for different markets, products and sales volumes.

Enhance protection

You are being protected against suppliers defaulting, going bankrupt or defaulted charges.

Increase visibility: Individual reference numbers that link consumer bookings with B2B payments

Protect liquidity: With enhanced credit lines through card payments

Reduce fraud risk: By limiting consumer card details being exposed and leveraging secure, one-time-use VCNs

Efficient refund process: Facilitated through enhanced and accurate reconciliation.

Download case studies.

Enhance protection

You are being protected against suppliers defaulting, going bankrupt or defaulted charges.

Increase visibility: Individual reference numbers that link consumer bookings with B2B payments

Protect liquidity: With enhanced credit lines through card payments

Reduce fraud risk: By limiting consumer card details being exposed and leveraging secure, one-time-use VCNs

Efficient refund process: Facilitated through enhanced and accurate reconciliation

Streamline and automate operations

Bring new and necessary efficiency to your daily oversight of payment flows and customer inquiries, allowing your team more time to focus on meaningful business operations.

Reduce complexity with fixed interchange rates and bundled core rates

Automate reconciliation and reporting

Simplify inquiry management

Forecast payment flow more accurately

Reduce PCI constraints

Reduce risk and fraud

By digitizing payment flows, the program better prevents fraud and failed payments, ultimately reducing risk and delivering savings to your business.

Leverage chargeback protection

Dramatically reduce risk of fraud with accurate data and tracking

Remove risk of bounced checks or failed payments after completed trips

Download case studies.

Reduce costs

Digitization and an overall more streamlined and efficient process lowers expenses by significantly reducing time and effort dedicated to legacy payment management processes.

Reduce costs associated with manual processes

Simplify the management of commissions and rebates

Manage cash flow more easily with guaranteed payment timing

Reduce DSO (working capital reduction)

Download case studies.

Download case studies.

Why use the Mastercard Wholesale Travel Program?

Through virtual card technology, fixed interchange rates and transparent issuing and acquiring core fees, the Mastercard Wholesale Travel Program reduces costs, enables operational efficiencies and decreases risk for travel agencies and travel suppliers alike.

Maximize sales

The multiple rate tiers and fixed interchange rates provide the travel industry with a flexible framework to address the unique economic needs of the industry facilitating commercial negotiations between travel agents and travel suppliers.

For travel agencies, enabling closer relationships with suppliers to increase the range of products and generate additional sales

For travel suppliers, an ability to define payments terms for different markets, products and sales volumes.

Enhance protection

You are being protected against suppliers defaulting, going bankrupt or defaulted charges.

Increase visibility: Individual reference numbers that link consumer bookings with B2B payments

Protect liquidity: With enhanced credit lines through card payments

Reduce fraud risk: By limiting consumer card details being exposed and leveraging secure, one-time-use VCNs

Efficient refund process: Facilitated through enhanced and accurate reconciliation.

Download case studies.

Enhance protection

You are being protected against suppliers defaulting, going bankrupt or defaulted charges.

Increase visibility: Individual reference numbers that link consumer bookings with B2B payments

Protect liquidity: With enhanced credit lines through card payments

Reduce fraud risk: By limiting consumer card details being exposed and leveraging secure, one-time-use VCNs

Efficient refund process: Facilitated through enhanced and accurate reconciliation

Streamline and automate operations

Bring new and necessary efficiency to your daily oversight of payment flows and customer inquiries, allowing your team more time to focus on meaningful business operations.

Reduce complexity with fixed interchange rates and bundled core rates

Automate reconciliation and reporting

Simplify inquiry management

Forecast payment flow more accurately

Reduce PCI constraints

Reduce risk and fraud

By digitizing payment flows, the program better prevents fraud and failed payments, ultimately reducing risk and delivering savings to your business.

Leverage chargeback protection

Dramatically reduce risk of fraud with accurate data and tracking

Remove risk of bounced checks or failed payments after completed trips

Download case studies.

Reduce costs

Digitization and an overall more streamlined and efficient process lowers expenses by significantly reducing time and effort dedicated to legacy payment management processes.

Reduce costs associated with manual processes

Simplify the management of commissions and rebates

Manage cash flow more easily with guaranteed payment timing

Reduce DSO (working capital reduction)

Download case studies.

-

31 Mar 22

Partner News

Mastercard names Chad Wallace as executive vice president of B2B SolutionsMastercard today announced that Chad Wallace has joined the company’s Global Product and Engineering ...Read moreMastercard names Chad Wallace as executive vice president of B2B Solutions - News & announcementsMastercard today announced that Chad Wallace has joined the company’s Global Product and Engineering organization as Executive Vice President of B2B Solutions and a member of the company’s Management Committee. He will oversee the company’s industry-leading commercial product offering, including its corporate travel and expense (T&E) management products, purchasing cards, virtual cards, B2B payments, and fleet card products, with a focus on enabling the digital transformation of corporate payments across accounts payable, procurement and treasury. “Chad is joining Mastercard at an exciting time where B2B and commercial solutions are essential in enabling the shift to a digital economy for corporates,” said Craig Vosburg, Mastercard’s Chief Product Officer. “Chad’s diverse leadership experience across the industry will provide significant value for our customers around the world. His digital products expertise, proven track record and high energy will support our continued focus to drive innovation in the B2B space.” Chad joins Mastercard from Goldman Sachs, where he was the Global Head of Digital for Transaction Banking within its Investment Banking division. In this role, he led the digital product and design organization responsible for building the cash management offering inclusive of liquidity and payment solutions to support the launch of Transaction Banking in various markets around the globe. Prior to joining Goldman Sachs, he was the Head of Digital Experiences for the Commercial Bank at Capital One, where he led a team responsible for migrating the treasury management digital experience to the cloud. Chad also previously held leadership roles at TD Ameritrade, E*TRADE Financial, and SunTrust. He earned a B.A. in Business Administration at Sam Houston State University. Chad is a passionate leader in the LGBTQ+ community with experience leading Diversity, Equity and Inclusion (DEI) programs to accelerate commercial opportunities, expand global partnerships, and assist partners in establishing their own DEI activities. -

14 Dec 21

Partner News

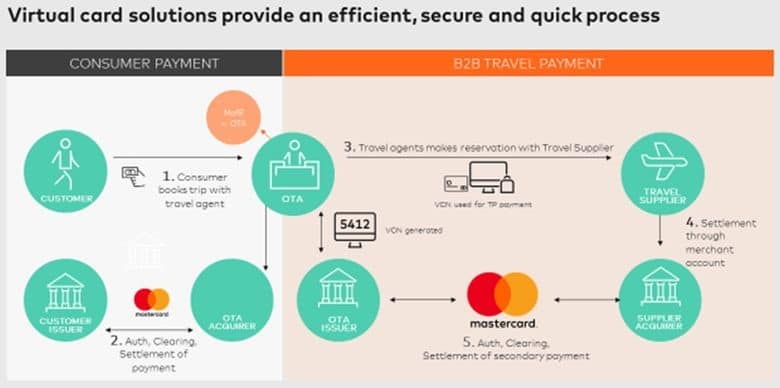

B2b Travel Payments: It’s Time To Improve The Experience – MastercardFran is excited - she’s planning a reunion getaway for her college friends. Fran has ...Read moreB2b Travel Payments: It’s Time To Improve The Experience – Mastercard - News & announcementsFran is excited - she’s planning a reunion getaway for her college friends. Fran has researched flights, hotels, car rentals, restaurants, and entertainment, and chosen Du Journey, an online travel agency, to help her with the bookings. Since Fran uses her smartphone to buy everything from daily coffee to new shoes, she’s certain this online travel payment experience will also be a breeze. Fran is disappointed - the travel agent couldn’t be more helpful, but in terms of payments, the agency acts only as the intermediary for all the suppliers involved in Fran’s trip. Her card details are passed on to the airlines, hotel, ticket brokers, and the other merchants—making her feel less secure. Equally confusing from Fran’s perspective, trip management is not as simple and straightforward as she’d like. She has multiple charges on her card statement, from suppliers other than Du Journey, and she’s not certain who to call if she has a change in plans or runs into trouble with a booking. Fran’s travel agent isn’t happy either - as the global travel industry has grown into a $2.2 trillion industry, the number of travel providers that Du Journey relies on has expanded significantly. In addition to well-established brands, they work with unfamiliar new suppliers to deliver the desired experiences to their clients. Because Du Journey has a pass-through payment model, it is the airlines, hotels, tour operators and various smaller suppliers that are charging Fran’s card. The travel agent has worked hard to earn Fran’s loyalty and now needs to manage her queries regarding the numerous charges she can now see on her statement. What if a supplier defaults or misprocesses a booking? Or loses Fran’s information in a data breach? Fran will blame Du Journey for the failure—and future business goes out the window. Travel suppliers, meanwhile, are worried about their margins - the growing volume of travel-related payments is forcing travel suppliers to shoulder an increasingly higher risk burden related to fraud and charge backs, and associated administrative work. It seems that business to business payments across the travel space have a long way to go to catch up with the speed, simplicity and convenience delivered in the consumer world, There must be a better way to give Fran the frictionless payment experience she expects, make Du Journey the merchant of record, while simplifying how the agency can pay suppliers and reduce the risk and workload. Industry opportunity and risk have never been higher The global travel industry has experienced continuous growth over the last decade. In 2017, worldwide annual air passenger numbers topped four billion for the first time. That number is expected to nearly double to 7.8 billion passengers by 2036. Millennials and Generation Z are key drivers of this skyrocketing growth. Adults aged 18-34 travel the most often - 35 days a year for millennials - and are likely to spend more money on vacations than any other age group. Young adults, in particular, place high demands on the online travel purchase experience. These digital natives use social media and websites as their primary sources for travel inspiration and information, and gravitate naturally to using online travel agencies. They expect to make seamless travel transactions from any smart device - phone, tablet, watch, or even their digital assistant - and expect their personal information will be secure. Given the growth in travel bookings, the new players entering the market, emerging regulations, and evolving consumer expectations for service, travel merchants are feeling extreme pressure, especially in the B2B payments space. Typically, there are two types of B2B payment flows.- The pass-through model: The travel agency facilitates the transaction and passes the card information to suppliers who then settle the payment directly with the consumer. This model subjects the consumer to a higher risk of data exposure. Moreover, consumers have to deal with multiple merchants, many of them unknown to them, which can be confusing and frustrating.

- The merchant model: More and more travel agencies are turning to the merchant model. The travel agency is the merchant of record, accepting the customer’s payment, authorising the transaction, and supplying the booking. The agency then arranges secondary payment to the various suppliers. These payments typically rely on legacy payment methods such as cash transfers. Such payments result in long settlement periods, poor reconciliation methods, and lack of cash flow visibility.

Here are four ways that virtual cards can help improve the entire travel ecosystem:

Here are four ways that virtual cards can help improve the entire travel ecosystem:

- Virtual cards recognise the consumer is king

- Virtual cards put reconciliation on autopilot

- Virtual cards are purpose-built for compliance

- Virtual cards fight fraud

-

11 Mar 21

Partner News

Amadeus and Mastercard expand partnership to accelerate the adoption of virtual payments in travelExpanded partnership means Amadeus will support innovative payment offerings across the travel industry through ...Read moreAmadeus and Mastercard expand partnership to accelerate the adoption of virtual payments in travel - News & announcementsAmadeus and Mastercard today announce a five-year extended global collaboration to help broaden access to virtual card payments across the travel ecosystem. Through this relationship, Amadeus and Mastercard will continue to provide flexible, secure, and efficient ways to make and receive payments. Today’s expansion builds on an existing strategic relationship committed to offer a fast, secure, and automated way to pay and get paid through Amadeus’ B2B Wallet payment platform with virtual payment technology offered through the Mastercard Wholesale Program. The program is a solution specifically designed for the travel industry utilising virtual card technology to help enhance payment protection and increase visibility for transactions between travel agencies and their suppliers. Virtual cards can protect cashflow, mitigate risk of default and simplify back-office reconciliation while helping to improve the payment experience for both travel agencies and travel suppliers, such as airlines and hotels. Bart Tompkins, Managing Director Payments, Amadeus commented: “The way travel agencies make payments to suppliers is changing. Virtual card payments help agencies respond to the challenges of COVID-19 by protecting cashflow, reducing risk, and improving back-office efficiency, whilst also improving settlement terms for suppliers. We’re pleased to continue our longstanding partnership with Mastercard. Our commitment is to ensure our customers can access a wide range of virtual card payment methods from the Amadeus B2B Wallet.” Kevin White, Director - Travel, Enterprise Partnerships, Mastercard commented: “Mastercard has long pioneered virtual card innovation and remains committed to helping the travel industry benefit from greater payment protection and enhanced transaction visibility through the Mastercard Wholesale Program. We’re thrilled to extend our partnership with Amadeus, a collaboration committed to leveraging expertise and innovations from both organizations to support recovery and growth for the travel sector. Now, more than ever, it is essential for players across the travel industry to come together to not only address the evolving needs today but to realize a stronger and more resilient future for the entire travel ecosystem.” -

11 Jan 02

NEWS

Holidaymakers bring Christmas cheer to BAAChristmas holidaymakers helped airports group BAA show a marked improvement in passenger numbers for December ...Read moreHolidaymakers bring Christmas cheer to BAA - News & announcementsChristmas holidaymakers helped airports group BAA show a marked improvement in passenger numbers for December compared to the two previous months. Passenger volume was down by 6.4% compared to December 2000, suggesting that people are starting to travel again after the September 11 terrorist attacks. In October and November traffic was down by 12% and 10.6% respectively. BAA said: “Whilst this represents continued progress on the results of October and November, much of December's improvement can be attributed to very strong Christmas holiday traffic, where in the 7 days ending December 31, passenger numbers were similar to last year.” During December, BAA’s seven UK airports handled 8.2 million passengers. The North Atlantic and other long haul markets showed the strongest recovery from the post September 11 fall with North Atlantic traffic down by 13% in December, while other long haul traffic fell by 6.0%.Learn more about : Vibe

Check Our partner Zone : Vibe

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific