ANIXE – Travel Market Trends 2022.11 Get used to growth as pandemic impact is negated

This summer’s high season came about with great expectations. Finally free from the pandemic, tourists with pent-up aspirations of travel were to bring us roaring back to the pre-pandemic golden age levels of bookings.

Well, to the surprise of our industry’s pessimists, those expectations became a reality. September’s booking figures indicate that we are back to, and in some markets, have already exceeded 2019’s high watermark. But, before we take a look at our data, let’s see what’s happening in the industry as a whole, and whether the implications match our optimism.

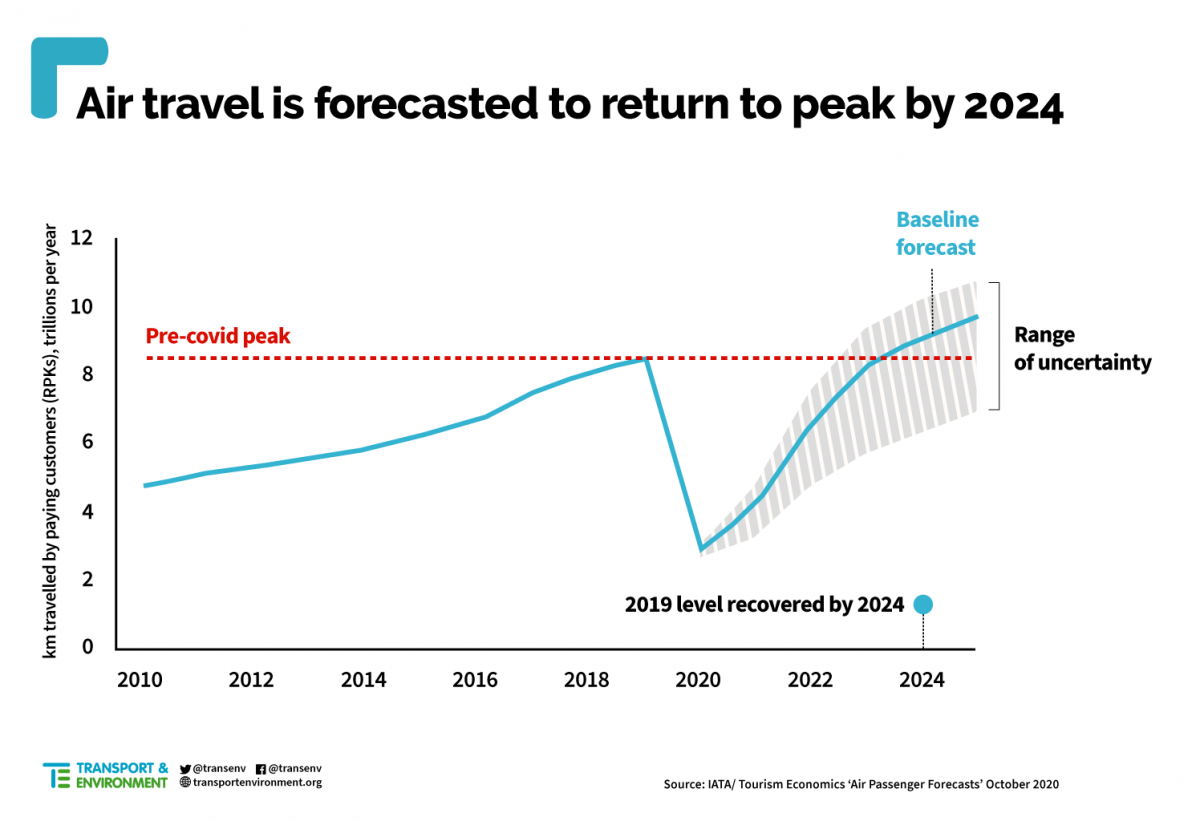

Signs of a return to normalcy can be seen all over the travel industry. For example, airlines worldwide plan to expand capacity to meet current demand.

At the ALTA Leaders Forum in Buenos Aires, the CEOs of Latin America’s major airlines painted a positive outlook. Roberto Alvo, the CEO of Latam Airlines Group – the region’s largest, stated, “We are at a period of strong recovery of [the] industry,”. And Avianca CEO Adrian Neuhauser added, “We are working to add capacity because it is an over-demanded market nowadays”.

Further figures from South America, provide proof that the travel industry has not only recovered, but has started to grow. Passenger counts in Mexico and Columbia have already exceeded pre-pandemic numbers, with total passenger increases of 14% and 9%, respectively. At least in some parts of the world, it seems that COVID is now a distant memory.

And it is not only in Latin America where we can see airline chiefs with huge smiles on their faces. Emirates president Tim Clark describes flights as being “full-up” as far out as March and that he sees a “capacity hole” that, due to staffing issues and maintenance, the company cannot fill in the short term. Nevertheless, Emirates expects to have its full fleet up and flying by next summer.

The sentiments of Emirates’ president are also parroted by the CEOs of Lufthansa, Air France-KLM, Delta Airlines and American Airlines, who are now in a race to increase capacity to meet the demand of would-be travellers.

Under-capacity could be good news for said travellers as it means that high prices are not only a consequence of the global cost-of-living crisis but also due to the under-capacity of airlines. However, with airlines planning to have their full fleets back in the air as soon as possible, we will likely see price reductions going into the second quarter of 2023 as supply catches up with demand. Great news if you’re planning a summer 2023 getaway.

Elsewhere in the industry things are looking up too. On Tuesday, Airbnb recorded its highest-ever income and profit in the 3rd quarter of 2022. An increase in demand catapulted the company’s net income by 46% compared to last year’s figures for the same quarter.

Furthermore, the 2022 U.S. Family Travel Survey, released last Wednesday, shows that a massive 85% of American parents plan to travel with their children in the next 12 months.

So, although high inflation will undoubtedly continue to affect travel demand, we might say that, due to lockdowns and restrictions, travel products are becoming economically quasi-inelastic, where demand remains the same even as prices go up.

Great news for travel industry players!

And the good news just keeps rolling in; our own data shows that this recovery isn’t just isolated to certain parts of the industry but is something we are seeing across the board.

So, without further ado, let’s look into our data gathered from the Resfinity Booking engine to see if what we see in other parts of the industry is reflected by the reality of our own numbers.

The good fortune and trend of recent months, continuing even outside the holiday season, prove that travellers are no longer concerned about the pandemic. Instead, we are travelling as before, and demand fluctuations correspond to similar monthly fluctuations as before the pandemic.

Recent months fit this thesis perfectly. October 2022 generated a nearly 12% drop in bookings relative to late September. However, their volume represented 97.5% of October 2019 levels globally and as high as 106% in the German market. It is excellent news but somewhat of a surprise given the current energy crisis and the ongoing war in Ukraine.

In October 2022, German travellers went mainly to domestic destinations, Turkey, the US and Spain. Although still at a high level, the latter’s share of reservations scores a significant decline both monthly and annually. We also recorded large declines in other vacation destinations such as Italy and Greece. In contrast, we recorded large increases in demand for trips to Egypt, which is already overbooked in major resorts through till the end of November.

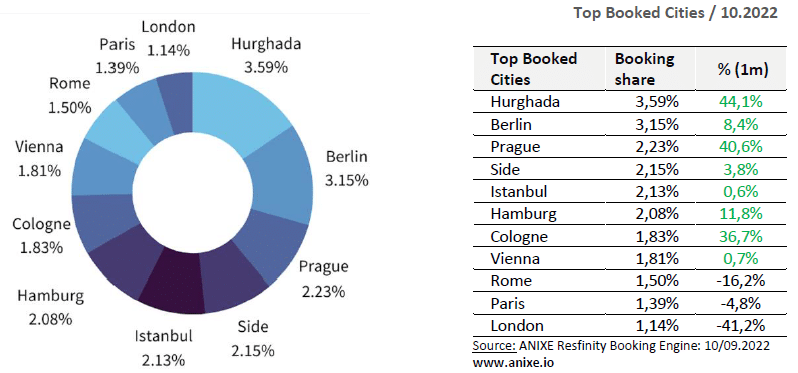

In October 2022 – for the first time in many months – Spanish resorts gave way to Antalya, noting a drop in bookings of close to 40% but remaining the second most popular destination for the month. Hurghada in Egypt was also very popular, as were several German destinations, including Berlin, Frankfurt, Hamburg, Munich and Cologne.

The most popular destinations in October 2022 were Hurghada, Berlin, Prague and two popular Turkish resorts: Side and Istanbul. On a monthly basis, Hurghada and Prague, in particular, enjoyed about a 40% increase in popularity. For Prague, this growth is more impressive compared to the period before the pandemic – its increase in the share of reservations is about 32%.

Before the pandemic, Berlin and Hurghada were also the most popular among German tourists during the same period. Rome was also in the top 5 then, although its popularity has dropped by more than 16% in the last month.

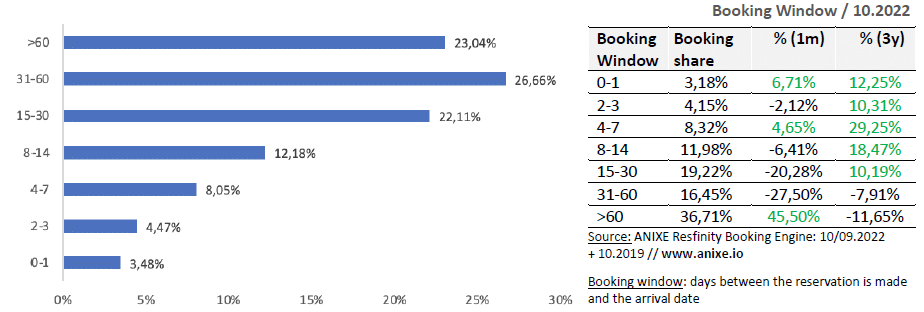

In October 2022 – just like three years ago – interest in early booking offers (31-60 days or more) dominated, rising by as much as 45% from last month! This may be closely linked to New Year’s Eve bookings and ski resorts that German tourists are so fond of.

Interestingly, it is evident that the uncertainty of the current times has receded into the background, that interest in these offers is growing rapidly. However, the pandemic experience of recent periods shows that autumn and winter are only conducive to travel planning if offers include the possibility of free cancellation.

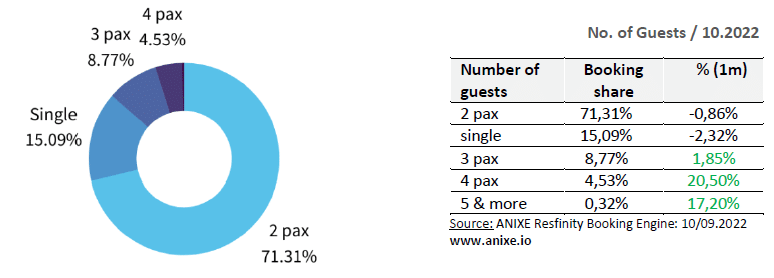

Another month in a row confirms the trend showing the profile and group size of the average traveller—groups of 2 people and singles dominate. Yet, surprisingly, the share of single bookings in October 2022 was 9% lower than in October 2019. Certainly, the unabated popularity of remote work and reduced business travel played a role.

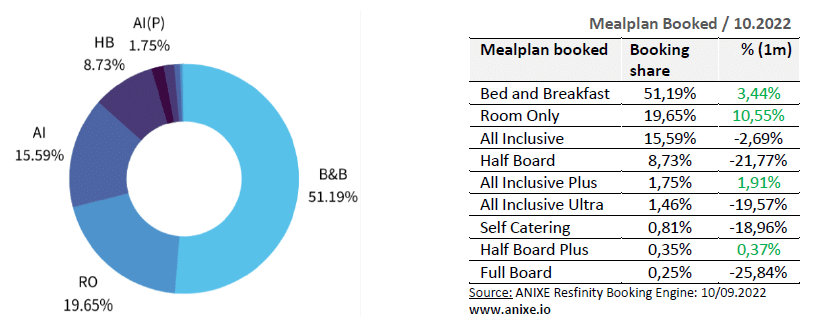

ANIXE’s travel industry data from our Resfinity booking engine shows that a large share of 1-2 person trips correlates with the overwhelming popularity of rooms with breakfast and rooms without meals. However, the latter’s percentage, despite increasing by 10% monthly, remains 17% lower than in the same period before the pandemic.

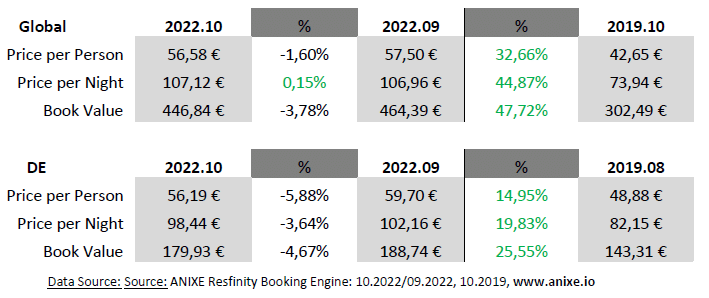

As far as prices are concerned, after the holiday season, when demand and prices for hotel services are highest, small average decreases are noticeable, especially in the German market, reaching up to nearly 6% per person. Nevertheless, compared to the pre-pandemic period, current average prices are significantly higher by up to 15% per person or 20% per night. Globally, this disparity is even more significant, and the difference is twice that of the German market.

On the one hand, this is due to the hotel sector’s desire to make up for post-pandemic losses. Still, on the other hand, creeping inflation is weighing down the European economy and significantly affecting price changes.

The holiday season brought the expected recovery to the tourism market. The positive trend has been in place for many months, responding to demand changes like before the pandemic. It could be said that we have learned to travel despite everything, which from the perspective of travel companies, is excellent news.

Unfortunately, high global inflation compounded by the war in Ukraine and the food and energy crises may increasingly disrupt this idyllic picture of the tourism market. Also ahead is the autumn-winter period – i.e., the exacerbation of pandemics.

How much will these factors be reflected in the tourism market dynamics in the coming months? Will the pandemic prevent us from going to some change resorts again? Which destinations will prove to be a hit that will resist the recession? To find out, follow your reliable source of travel industry trends; ANIXE Insights.

Stay tuned. Stay safe. Plan your trips.

Team ANIXE

Learn more about Anixe

[related_post]Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

TAP Air Portugal to operate 29 flights due to strike on December 11

Qatar Airways offers flexible payment options for European travellers

Airbnb eyes a loyalty program but details remain under wraps

Air Mauritius reduces frequencies to Europe and Asia for the holiday season

Major rail disruptions around and in Berlin until early 2026