Dollar to euro parity: what does this once-in-20-years ‘gift’ mean for European hoteliers and destinations? Mabrian Technologies

- Data from travel intelligence provider Mabrian shows correlation between exchange rate and search demand from US source market

- Mastercard confirms that American travellers in Spain spend twice the amount other European travellers do

- Luxury tourism event Forward_MAD calls this a ‘gift not to be missed’ for hoteliers concerned about the post-September outlook

- Polling from US metasearch company WayAway shows that almost half of Americans now more keener to travel to Europe as a result of parity

- Revenue management experts Beonprice provides hoteliers with tips on how to market themselves

Carlos Cendra Cruz, Sales & Marketing Director of travel intelligence provider Mabrian comments:

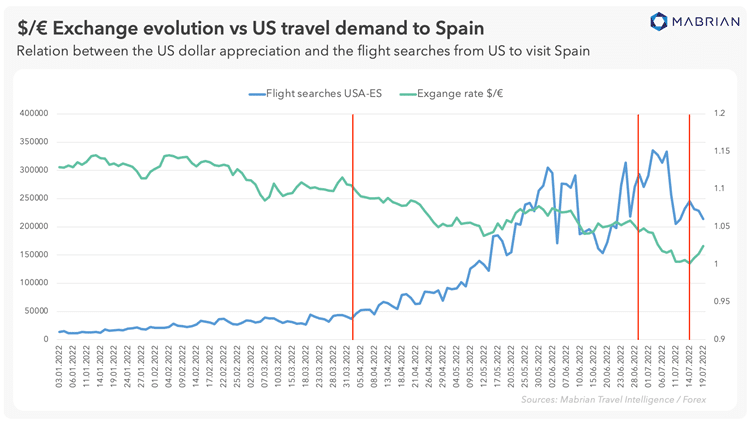

“We have had a close look at the relationship between the Euro/Dollar exchange rate and the level of search demand for flights from the US to Europe over the course of this year.

“Whilst you might expect to see greater demand for Europe as the summer months approach, we can nonetheless see a very clear correlation between the value of the Euro and demand for travel – with clear periods where an increase in the cost of acquiring a Euro results in a fall in demand for flights to Europe, and vice versa.

“Aside from telling us that right now European hotels should be marketing themselves hard to US travellers, very clearly this shows us that hotels and tourism boards around the world should factor in – amongst other important elements too – exchange rates when considering where to focus their marketing funds.

“But we shouldn’t forget though that this cuts both ways and no one should become over reliant on any one market where a sudden shift in exchange rates – or as this research shows even a relatively small shift – can result in massive decreases in demand.”

Paloma Real, general manager of Mastercard Spain comments:

“Before the pandemic, the United States was one of the most important source markets for the Spanish tourism sector in terms of both the number of visitors (3.2 million in 2019) and spending (€6,774 million). Tourists from North America have an average expenditure twice as high as that of European tourists (2,087 euros on average vs. 1,175 euros for German tourists, 1,115 euros for UK tourists or 763 euros for French tourists). This is mainly due to the fact that, when travelling by long-haul, tourists from North America usually spend more days in the destination and travel on a larger budget than Europeans entering our country by road and/or shorter-haul flights.

“Due to the pandemic, the US-Spain corridor has been one of the destinations most affected by the restrictions, and the number of visitors has dropped significantly (1 million visitors in 2021). With the end of the restrictions and the fall of the euro against the dollar, it is expected that in 2022 the number of visitors and spending will be close to those of 2019. The euro-dollar peg is expected to be a lever to accelerate the recovery of visitors to the country and average visitor spending.

“Our latest travel trends study published in June “Travel 2022: Trends & Transitions” anticipates a global shift in travel and consumption habits. Spending on experiences (activities, restaurants, bars and leisure) has already recovered to 2019 levels and, for the first time in history, has surpassed spending on shopping. Tourists are increasingly looking for unique and, if possible, personalised experiences that allow them to enjoy the trip rather than buying souvenirs and products that they can easily purchase from home.

“On the other hand, we see this trend confirmed by the fact that more and more tourist destinations are relying on Mastercard to develop special experiences and promote them to source markets through our priceless.com platform. As a result, they are accelerating the recovery of the tourism sector in their destinations.”

Fabián Gonzalez, Founder of Forward_MAD, a luxury tourism conference taking place from October 5th to 7th in Madrid comments:

“Whilst occupation rates are high right now many hoteliers are already asking what will happen in September. After all they have two years of COVID debt behind them to make up for along with staff shortages, rising interest rates and inflationary worries too.

“For the luxury segment in particular the potential increase in demand from one of the biggest outbound source markets in the world really is a gift not to be missed. Not least as US travellers are dream guests: they spend more, stay longer, book further in advance, enjoy the room service – and at the end they tip properly.

“But how do you capture such travellers? They have their own travel agencies and preferences that not all European hoteliers can easily tap into. Both Mabrian and Mastercard – who have some very valuable insights on this particular trend – will be on stage at Forward_MAD from October 5th to 7th to discuss this and more.”

Polling of a statistically relevant sample of 250 American citizens late last week from WayAway, the United States price comparison website for cheap flights, showed that:

- Almost half (49%) are now keener to travel to Europe than before as a result of the dollar to euro parity.

- The area where they felt they are most likely to benefit from this change is in shopping (63%) closely followed by dinning out (60%).

Neville Isaac, Chief Customer Officer of hotel revenue management tool provider Beonprice comments:

“Post Covid we have seen a significant resurgence of visitors from the USA and now the parity between the dollar and the euro is the perfect moment to optimize the segment.

“Traditionally in Europe, the US visitor has the highest overall spend, a longer booking window, and length of stay than almost any other feeder market. Typically also, the data shows us that they book superior room types, so the overall contribution to profits from this segment is extremely high.

“Although we are seeing extremely high ADRs (average daily rates) this year across Europe (around 30% above 2019 levels), now with the euro/dollar parity hotels – especially those cities with an international airport – have a great opportunity to increase volume from the high value US market, where the exchange rates make these destinations attractive.

“In order to take advantage of this opportunity, we recommend that hotels study the data and consider:

- From which US cities are they getting demand?

- How far in advance do their US customers typically book?

- Which channels are they using to buy?

- And finally which products (room types, rate types etc,) are the most popular?

“With this information Revenue Managers can sit down with marketing and design campaigns to reach these markets.”

Learn more about Mabrian Technologies

Have your say Cancel reply

Our emails to you has bounced travelmole.com Or You can change your email from your profile Setting Section

Your region selection will be saved in your cookie for future visits. Please enable your cookie for TravelMole.com so this dialog box will not come up again.

Price Based Country test mode enabled for testing United States (US). You should do tests on private browsing mode. Browse in private with Firefox, Chrome and Safari

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

CLIA expands trade support with expedition event

Qatar Airways adding Manchester flights

Jet2 unveils Samos as new Greek destination for summer 2026

EU entry-exit system delayed again

ATC strike in Greece could disrupt flights this week