Faster arrivals and departures for your B2B payments – Mastercard

Evolving virtual card payment solutions for the global travel industry

As digitization accelerates the world over, and as travel behaviors shift, the travel industry is increasingly seeing the need for innovative and collaborative payment solutions.

Using virtual card technology and an innovative pricing model, the Mastercard Wholesale Travel Program is designed to bring scalable and seamless cross-border B2B payments to the entire industry – ultimately creating a more secure, frictionless experience for you and your customers and accelerating future growth opportunities.

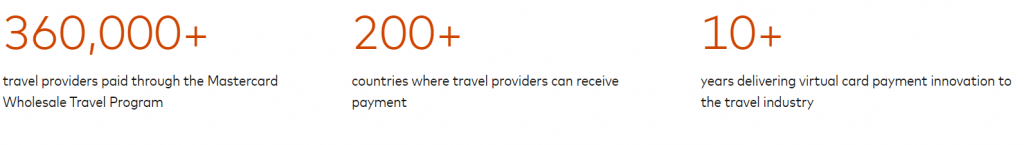

Over 360,000+ travel providers across 200+ countries worldwide already rely on us to increase reconciliation efficiency, enable payment flow visibility, preserve liquidity, provide payments protection and enable payment guarantees. Start with partners and Start Something Priceless™.

Why use the Mastercard Wholesale Travel Program?

Through virtual card technology, fixed interchange rates and transparent issuing and acquiring core fees, the Mastercard Wholesale Travel Program reduces costs, enables operational efficiencies and decreases risk for travel agencies and travel suppliers alike.

Maximize sales

The multiple rate tiers and fixed interchange rates provide the travel industry with a flexible framework to address the unique economic needs of the industry facilitating commercial negotiations between travel agents and travel suppliers.

For travel agencies, enabling closer relationships with suppliers to increase the range of products and generate additional sales

For travel suppliers, an ability to define payments terms for different markets, products and sales volumes.

Enhance protection

You are being protected against suppliers defaulting, going bankrupt or defaulted charges.

Increase visibility: Individual reference numbers that link consumer bookings with B2B payments

Protect liquidity: With enhanced credit lines through card payments

Reduce fraud risk: By limiting consumer card details being exposed and leveraging secure, one-time-use VCNs

Efficient refund process: Facilitated through enhanced and accurate reconciliation.

Enhance protection

You are being protected against suppliers defaulting, going bankrupt or defaulted charges.

Increase visibility: Individual reference numbers that link consumer bookings with B2B payments

Protect liquidity: With enhanced credit lines through card payments

Reduce fraud risk: By limiting consumer card details being exposed and leveraging secure, one-time-use VCNs

Efficient refund process: Facilitated through enhanced and accurate reconciliation

Streamline and automate operations

Bring new and necessary efficiency to your daily oversight of payment flows and customer inquiries, allowing your team more time to focus on meaningful business operations.

Reduce complexity with fixed interchange rates and bundled core rates

Automate reconciliation and reporting

Simplify inquiry management

Forecast payment flow more accurately

Reduce PCI constraints

Reduce risk and fraud

By digitizing payment flows, the program better prevents fraud and failed payments, ultimately reducing risk and delivering savings to your business.

Leverage chargeback protection

Dramatically reduce risk of fraud with accurate data and tracking

Remove risk of bounced checks or failed payments after completed trips

Reduce costs

Digitization and an overall more streamlined and efficient process lowers expenses by significantly reducing time and effort dedicated to legacy payment management processes.

Reduce costs associated with manual processes

Simplify the management of commissions and rebates

Manage cash flow more easily with guaranteed payment timing

Reduce DSO (working capital reduction)

Learn more about Mastercard

Have your say Cancel reply

Our emails to you has bounced travelmole.com Or You can change your email from your profile Setting Section

Your region selection will be saved in your cookie for future visits. Please enable your cookie for TravelMole.com so this dialog box will not come up again.

Price Based Country test mode enabled for testing United States (US). You should do tests on private browsing mode. Browse in private with Firefox, Chrome and Safari

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

CLIA expands trade support with expedition event

Qatar Airways adding Manchester flights

Jet2 unveils Samos as new Greek destination for summer 2026

EU entry-exit system delayed again

ATC strike in Greece could disrupt flights this week