Riskified Ltd (RSKD.N), an online risk management platform backed by an affiliate of growth equity investor General Atlantic, notched a valuation of $4.3 billion after its shares jumped more than 28% in their stock market debut on Thursday.

Shares opened at $27, compared to Riskified’s initial public offering (IPO) price of $21 per share that helped raise $367.5 million.

The company, founded by Eido Gal and Assaf Feldman in 2013 to solve online payment fraud, sold 17.5 million shares in the IPO, of which existing shareholders offered about 200,000 shares.

Riskified aims to reduce risks related to online fraud for e-commerce businesses and has built a machine learning-based platform that minimizes payment risk.

“We’re opening offices in Australia, Shanghai, London, Mexico and Brazil, so there is much opportunity globally,” Chief Executive Officer Eido Gal told Reuters.

The Tel Aviv, Israel-based company recorded a 30% rise in revenue to $169.7 million for the year ended Dec. 31, 2020, a recent regulatory filing showed. However, it incurred a loss of $11.3 million in the same period.

Goldman Sachs, J.P. Morgan and Credit Suisse were the lead underwriters for the offering.

United Kingdom

United Kingdom United States

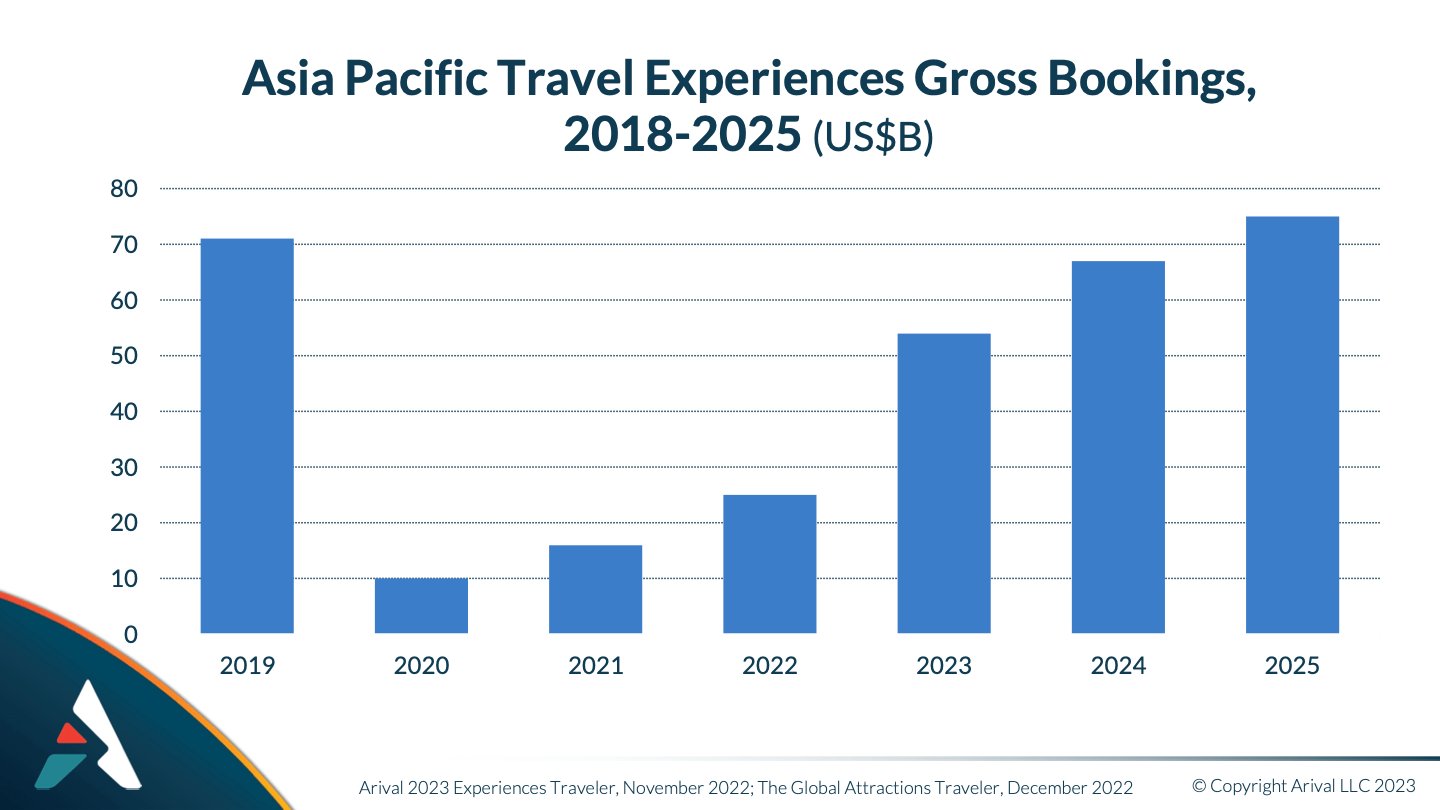

United States Asia Pacific

Asia Pacific

CLIA expands trade support with expedition event

Qatar Airways adding Manchester flights

Jet2 unveils Samos as new Greek destination for summer 2026

EU entry-exit system delayed again

ATC strike in Greece could disrupt flights this week