Summer tourism forecast: Balkans and south eastern Europe – Mabrian Technologies

Mabrian analyzes the forecast for tourism this summer in the Balkans and south eastern Europe

- Analysis reviews data related to air connectivity, the recovery of capacity and hotel prices for the main destinations in the region.

- Assessment of the impact of the lack of Russian tourists in south eastern Europe and how each market is recovering after the pandemic.

- Inspirational demand for Montenegro, Greece and Croatia is maintained.

Mabrian, the leading provider of data analysis and tourism intelligence globally, has analyzed the tourism outlook for this summer in the Balkans and south eastern Europe. The analysis reveals several trends regarding the pre-pandemic era and the recovery since last year.

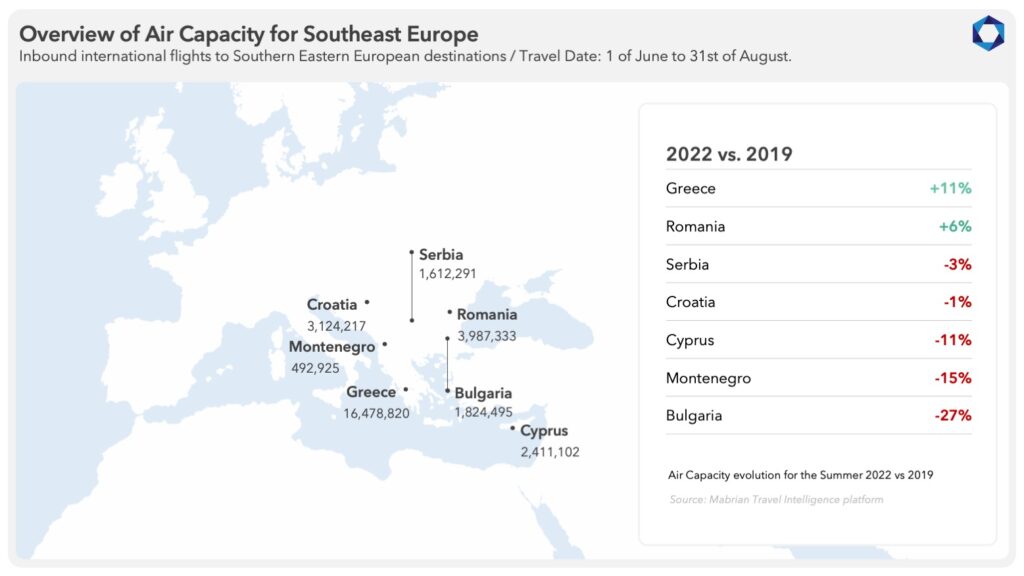

The analysis specifically looks at air capacity, taking the data from 2022 and comparing that with the data from the pre-pandemic summerof 2019. At the same time, hotel prices and inspirational searech demand are compared with summer2021 to understand the path of the recovery of tourism in these destinations in south eastern Europe.

Overall pre-pandemic air capacity is slowly recovering. However the level of recovery is very diverse across south eastern Europe and Mabrian identifies three groups of countries on this basis. The countries that are recovering the best are Greece and Romania. In the middle are Serbia and Croatia, whilst Montenegro, Bulgaria and Cyprus have a low level of recovery.

Meanwhile the price recovery has reached the hospitality sector, especially in 4-star hotels. For example Croatia, Greece and Bulgaria show an increase in prices in all types of hotel categories, while Cyprus is the only country on the list that shows a decrease in prices in 3, 4 and 5 star hotels.

It should be pointed out however that specifically in Cyprus in 2021 Russia was the third source market in terms of air capacity and the second in hotel reviews. The lack of Russian tourists for this summer has therefore caused a drop in hotel prices for this destination. The same issue can be highlighted in Serbia and Montenegro, since for these two markets Russia was also the fourth and third biggest issuing market, respectively. The absence of Russian guests could also affect the prices of luxury properties.

Croatia, Montenegro, Greece: the most inspiring destinations in the region

In terms of inspirational search demand, Croatia, Montenegro and Greece are at the top of Western European source markets when compared to other destinations in the region . However, apart from the United States and France for Greece, and Germany and France for Croatia, all other markets show a drop in inspirational search interest to these destinations compared to the same period in 2021 (according to the Mabrian share of searches indicator).

The average length of stay in Croatia is 8 days, that is 30% less than the average stay in Montenegro and 18% less than in Greece. Whilst Croatian 3- and 4-star hotel prices are the second highest in the region, which may interfere with inspirational demand.

In the case of Greece, the length of stay is decreasing as hotel prices have increased compared to 2021 (especially in 5-star properties, which have increased prices by 10%) and are the highest in south eastern Europe.

Looking at the two main markets of origin for the region, for the British market the data shows that there has been a slight drop in interest and searches, while the average length of stay is also shortening.

Likewise, Russia, despite its lack of direct connectivity, continues to show interest in traveling to Montenegro and staying for a longer period of time than in 2021.

According to Anna Borduzha, head of business development for Mabrian in Italy, the Balkans, Eastern Europe, and the US: “This analysis shows the different rates of recovery of some of the main holiday destinations in south eastern Europe. Undoubtedly, the instability caused by the conflict in Ukraine has affected them in two ways: on the one hand, generating uncertainty for potential visitors this summer from Northern Europe and Western Europe, and on the other, affecting the Russian source market, with an historically large weight in the region. In this context of continuous changes, it is essential to have the most up-to-date data and analysis in order to define the correct tourism recovery policies.”

Learn more about Mabrian Technologies

Our emails to you has bounced travelmole.com Or You can change your email from your profile Setting Section

Your region selection will be saved in your cookie for future visits. Please enable your cookie for TravelMole.com so this dialog box will not come up again.

Price Based Country test mode enabled for testing United States (US). You should do tests on private browsing mode. Browse in private with Firefox, Chrome and Safari

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific

Dozens fall ill in P&O Cruises ship outbreak

Turkish Airlines flight in emergency landing after pilot dies

Unexpected wave rocks cruise ship

Woman dies after going overboard in English Channel

Foreign Office issues travel advisory for winter sun destinations